Hubtel Introduces POS for Ghana Market; One Wallet to Accept All Payments

April 12, 2018 | 3 minutes read

As governments deepen their commitment to introduce citizens to a cashless economy, a key challenge to businesses and customers is the availability of affordable, convenient, and secure means of making cashless transactions. While some point-of-sale devices and cashless payment methods are available on the market, small and medium-sized businesses remain outpriced. Regular customers are largely unenthused in spite of the superior benefits of cash-lite transactions. The problem is exacerbated by different financial institutions offering different payment platforms. Mobile money services, run by telcos, remain unintegrated.

A contributing factor to this general disinterest in going cash-lite has been that existing technologies, mostly imported, do not satisfy the demands of the local market. Device costs, a requirement for internet connection in a market with unreliable connectivity, and concerns about security adversely affect customers’ appreciation and adoption of cashless platforms.

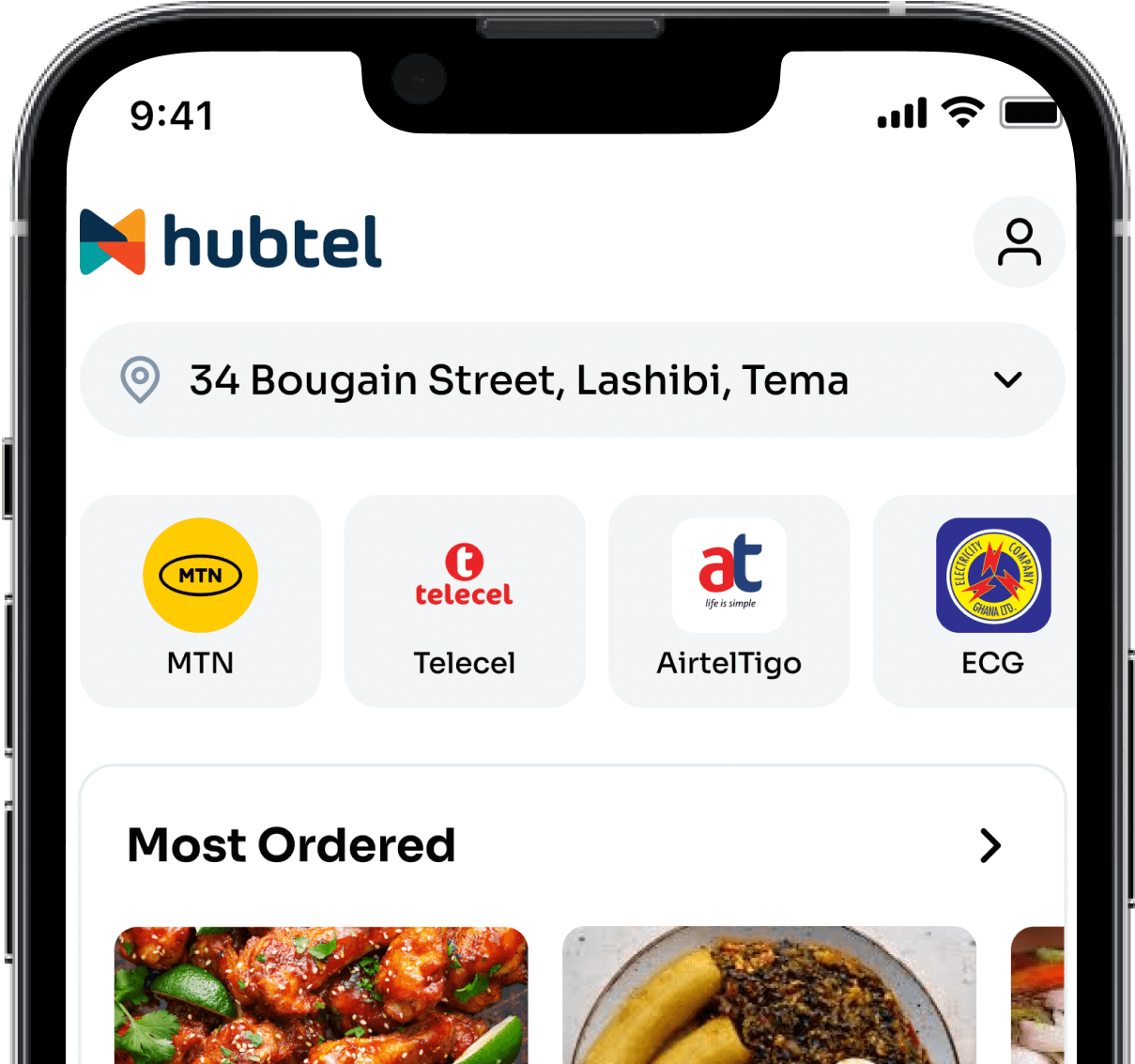

Hubtel POS is a solution designed with the necessities of developing economies like Ghana in mind. With Hubtel POS, all existing bank cards and mobile money wallets are integrated into one platform. This means businesses will be able to accept and process payments into one business wallet irrespective of the bank card or the mobile money wallet that the customer carries.

This streamlining of cashless payments means that businesses will no longer have to depend on multiple financial institutions for multiple point-of-sale devices, connected to different bank accounts. The barrier of customers unable to make payments for goods and services from mobile money wallets has been eliminated – it no longer matters which mobile money wallet a customer has, payments can be initiated easily from any phone.

With a single platform that processes payments from Visa, MasterCard, GHLink bank cards, and all mobile money wallets, Hubtel brings a keen understanding of the Ghanaian market to the industry. Hubtel offers businesses who sign up a free card reader to process bank card payments. On Hubtel POS, transactions for cash, card, and mobile money are instantly recorded; and customers receive free SMS receipts. Managers can sell and manage sales orders from their inventory. Hubtel POS also gives managers and business owners access to real-time reporting tools that help track sales and inform decision-making.

This introduction might just be the catalyst for the disruption that the market has been waiting for. The desire to bring innovative solutions to local business problems has once again introduced a product that understands the market it is intended for. This competent understanding of the market might just be what sets this new point of sale apart from what already exists. With businesses like KFC, Allied Oil, Compu Ghana, Equity Pharmacy and Jinlet Pharmacy and many others already using Hubtel POS, the market is lighting up for cashless transactions.

Related

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Hubtel Pledge Supports St. Augustine’s College with First Coding Lab in Ghana

April 12, 2024| 4 minutes read