Author: Hubtel

Reps From UBA Pay Working Visit to Hubtel

April 27, 2018 | 1-minute read

We were privileged to have reps from UBA pay a working visit to our head office in Kokomlemle over the week. The sales team took them on a test drive to have an experience with the Hubtel POS setup.

Top Stories

Introducing Gift Cards On Hubtel.me

April 18, 2018 | 1-minute read

By popular demand, we’ve made it possible for you to buy Gratis points as gift cards for others. Spread the love and share the feeling.

Customize gift cards and express yourself in your own words to those special people. How’s that for cool?

How it works:

- Go to More

- Select “Send a Gift Card”

- Choose gift card type (Happy Birthday, Thank You, Good Luck Charm, Congratulations or I Love You).

- Customize your message, add recipient number, amount and send.

Recipients can redeem the points as cash and use for any service on the app.

Let your family, friends and loved ones hear from you differently with the new Gift Card Feature.

The new Hubtel.me Gift Card feature is a simple way to express our deepest thoughts to the people that mean the most to us. Download the Hubtel.me app now and share the feeling.

The Rewards Never End.

Top Stories

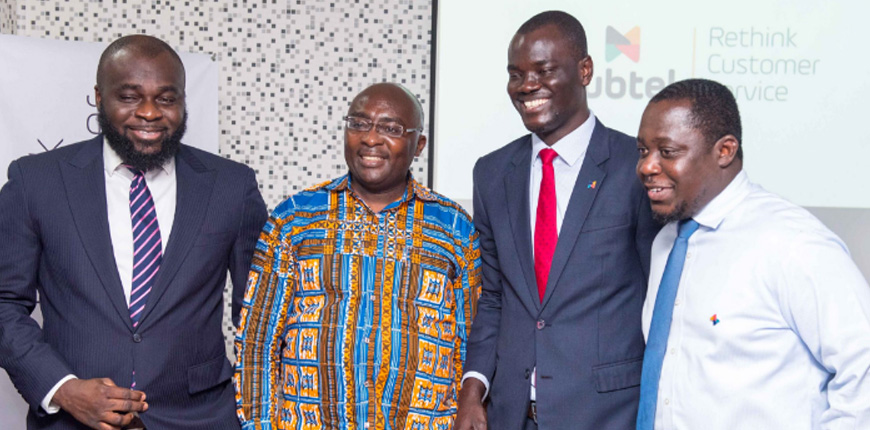

Vice President’s Working Visit to Hubtel

April 16, 2018 | 2-minute read

What a special day. The Vice President, Dr Mahamudu Bawumia paid a working visit to our head office in Kokomlemle, Accra on Monday, March 26.

Our Chief Executive Officer, Alex Adjei Bram, took Dr. Bawumia through the services of the firm after a familiarization tour of the office.

In his conversation with the Vice President, Alex Bram explained that Hubtel’s solutions are designed to enhance merchants’ businesses by offering a single platform where payments, customer engagement, and loyalty are managed. He continued that “We basically started this company with GHC15 but today we have branches in Ghana and Kenya. Our first product was bulk SMS which helped to enhance the communication system of businesses.” Alex Bram also talked about ongoing work with the Ghana Police Service and the company’s newly launched Pledge to donate 1% of its products and profits to worthy causes.

Dr. Bawumia was impressed by the youthfulness of the team at Hubtel. He lauded the firm and assured management of government’s commitment to creating an enabling environment for indigenous IT firms to thrive. He said, “We are happy there is so much talent in Ghana. We as a government want to create the environment for businesses to thrive in education, revenue collection, data management, and more. We want to encourage and support you.”

We are honored to have been among the technology companies selected. We are humbled and remain committed to doing our part to support businesses of all sizes and ensure technology plays a useful part in improving customer service across the country.

Top Stories

Hubtel Introduces POS for Ghana Market; One Wallet to Accept All Payments

April 12, 2018 | 3-minute read

As governments deepen their commitment to introduce citizens to a cashless economy, a key challenge to businesses and customers is the availability of affordable, convenient, and secure means of making cashless transactions. While some point-of-sale devices and cashless payment methods are available on the market, small and medium-sized businesses remain outpriced. Regular customers are largely unenthused in spite of the superior benefits of cash-lite transactions. The problem is exacerbated by different financial institutions offering different payment platforms. Mobile money services, run by telcos, remain unintegrated.

A contributing factor to this general disinterest in going cash-lite has been that existing technologies, mostly imported, do not satisfy the demands of the local market. Device costs, a requirement for internet connection in a market with unreliable connectivity, and concerns about security adversely affect customers’ appreciation and adoption of cashless platforms.

Hubtel POS is a solution designed with the necessities of developing economies like Ghana in mind. With Hubtel POS, all existing bank cards and mobile money wallets are integrated into one platform. This means businesses will be able to accept and process payments into one business wallet irrespective of the bank card or the mobile money wallet that the customer carries.

This streamlining of cashless payments means that businesses will no longer have to depend on multiple financial institutions for multiple point-of-sale devices, connected to different bank accounts. The barrier of customers unable to make payments for goods and services from mobile money wallets has been eliminated – it no longer matters which mobile money wallet a customer has, payments can be initiated easily from any phone.

With a single platform that processes payments from Visa, MasterCard, GHLink bank cards, and all mobile money wallets, Hubtel brings a keen understanding of the Ghanaian market to the industry. Hubtel offers businesses who sign up a free card reader to process bank card payments. On Hubtel POS, transactions for cash, card, and mobile money are instantly recorded; and customers receive free SMS receipts. Managers can sell and manage sales orders from their inventory. Hubtel POS also gives managers and business owners access to real-time reporting tools that help track sales and inform decision-making.

This introduction might just be the catalyst for the disruption that the market has been waiting for. The desire to bring innovative solutions to local business problems has once again introduced a product that understands the market it is intended for. This competent understanding of the market might just be what sets this new point of sale apart from what already exists. With businesses like KFC, Allied Oil, Compu Ghana, Equity Pharmacy and Jinlet Pharmacy and many others already using Hubtel POS, the market is lighting up for cashless transactions.

Top Stories

Vice President of the Republic of Ghana Pays Working Visit to Hubtel

March 27, 2018 | 1-minute read

What a special day. The Vice President, Dr Mahamudu Bawumia paid a working visit to our head office in Kokomlemle, Accra on Monday, March 26.

Our Chief Executive Officer, Alex Adjei Bram, took Dr. Bawumia through the services of the firm after a familiarization tour of the office.

Top Stories

Mobile Money: Saving Lives

March 1, 2018 | 3-minute read

Do you agree that hospitals can be daunting? Think about it – there are queues everywhere; right from your first step in the outpatient department, to looking for your folder, having your vital readings taken, getting to see your doctor, and then finally picking up medication at the pharmacy. In some cases, the need to be admitted or run extra recommended laboratory tests or scans without adequate financial preparation can be a punch below the belt if one has little time on their hands and can’t visit a bank.

Despite all these challenges, health institutions have one aim in mind – saving lives and improving health. Access to quality healthcare is an integral and necessary part of every nation’s development. With health care comes the need for money transfers and payments either for services or medication purchased. Countless lives have been lost in times past due to the “cash and carry system” in our nation’s health delivery.

The desire to solve these problems and improve patient convenience with payments led healthcare providers like the Airport Women’s Hospital and Equity Pharmacy to find innovative ways to solve the challenges that come with money payments for their service. Their search led them right to Hubtel.

Augustine, the accountant of Airport Women’s Hospital cites an example of a woman who was admitted for a day and was discharged that same day but had no paper money to pay. Her ability to pay via Mobile Money saved her the cost of staying an extra day until she had access to cash. Augustine further mentions the added convenience of varying forms of payment and the ability to track all Mobile Money transactions on all networks. With Hubtel’s POS service, errors can also be eliminated by being able to first verify the client’s name before any transaction is made. With the Health and Fertility Centre just about 9 minutes drive from the Kotoka International Airport, one would have no worries about carrying paper money before being attended to, with the added benefit of payment convenience.

With an unwavering desire to provide the best customer service in health delivery, payments for services and medication has seen some innovation. A glowing example is Equity Pharmacy, a pharmacy that now boasts of a doorstep delivery service to clients as a result of signing on to Hubtel’s POS service. Clients can now send prescriptions and electronic payments and expect their medication at their chosen point of delivery. Tracking of sales made and reconciliation of accounts through Hubtel’s platform has also been easier.

At Hubtel, we take pride in our ability to rethink customer service. Now we urge you to rethink Mobile Money: it is more than just a convenient tool that saves time; it can equally save lives.

Top Stories

KFC Dansoman Accepts All Forms Of Payments

February 26, 2018 | 1-minute read

Been to the Dansoman KFC recently? They now accept any form of payment when you order your favorite chicken – whether you pay with a mobile money wallet or bank card. No need to carry cash for your next order.

Top Stories

KFC Marina Mall Receives Mobile Money And Bank Cards As Payment Options

February 26, 2018 | 1-minute read

KFC Marina Mall has joined the trail of businesses that use Hubtel POS to power their payments. Anyone can now order any KFC pack and pay using Mobile Money or a Ghanaian-issued Bank Card. This is good news for both KFC and their clients. Hubtel POS is a more convenient way to receive payments in your shop or store.

Top Stories

KFC Osu Now Accepts Mobile Money And ATM Cards

February 26, 2018 | 1-minute read

Imagine paying for your next KFC order using any mobile wallet or bank card. That is just how KFC receives payment now using Hubtel POS. Your customers need a better way of making payments to you in your store. Use Hubtel POS and experience a new kind of payment.

Top Stories

Jinlet Pharmacy Goes Cash-Light With Hubtel POS

February 26, 2018 | 1-minute read

Jinlet pharmacy has become part of the growing number of businesses using Hubtel POS. We had the great privilege of setting them up. Signing up on Hubtel POS has helped create more convenience for their customers to pay either with a mobile money wallet or any Ghanaian issued bank card. Rethink how you accept payments from your customers with Hubtel.

Top Stories

Hisense Signs Onto Hubtel POS

February 26, 2018 | 1-minute read

Smart gadgets are everything these days, and Hisense has them all. By using Hubtel POS, Hisense now allows you to buy all your favorite gadgets using any mobile wallet or Ghanaian-issued bank card. Hubtel POS provides Hisense a better way to receive payment as a business and a more convenient way for their customers to make payments.

Top Stories

Boulevard Menswear Uses Hubtel POS

February 26, 2018 | 1-minute read

Let your customers pay you using any mobile wallet or Ghanaian-issued bank card. It is convenient for both you and your customers. Boulevard Menswear just joined the club. They accept all forms of payment because they signed up on Hubtel POS. Rethink your customers’ payment experience with Hubtel.