Author: Hubtel

2016’s FinTech Disruptors: How Can You Benefit?

February 29, 2016 | 6-minute read

We are in the golden age of technology. Within the larger movement; however, each one of us is directly influenced by the take off of a more recent and rapidly developing financial technology (FinTech) space—an industry projected to attract approximately $20 billion in funding by 2017, estimates Statista.

Financial technology is a democratizing force that can change our lives by making financial tools and services accessible, faster and more easily understood — most times at a lower cost. Complex algorithms now often take the place of traditional advisors, perhaps offering more efficient and personalized products for end users.

From budgeting tools to alternative lending and investment options, payments processing, and philanthropic platforms, we have a lot to gain from the advent of financial technology startups. Learn below about just a few ways in which you can leverage these hot new platforms before they inevitably become common applications for the entire public.

Payments Made Easy

The advent of payments technology has made consumer spending, and all other forms of payment easier, faster, and more secure. Payments technology startups, such as Square, help small businesses get off the ground by adopting easy to use and cheaper credit card payments processing. Instant, reliable transactions are important for day-to-day sales, along with employee payroll processing.

Venmo, a payments app, has provided a “free digital wallet” to the mobile devices of thousands, by allowing friends to connect quickly and securely via Facebook to request and send money to each other in a few taps on their phones. Furthermore, on the consumer side, platforms such as Apple Pay and Bitcoin continue to disrupt the traditional method of pay. When sending money abroad, individuals should consider using money transfer services such as TransferWise to save on international transfer fees.

Lend a Helping Hand

Peer-To-Peer (P2P) business models have fueled a new sharing economy revolution, with many products and services such as home rentals, cleaning services, and anything else under the sun being “uberized.” New FinTech startups have uberized the online lending space, allowing you to access funds through unconventional ways, without the help of big-name banks or a network of established lenders.

Platforms such as U.S.-based LendingClub and Prosper, and U.K-based Zopa have individually issued millions of dollars in loans, joining the rising number of tech unicorns in today’s entrepreneurial space.

Crowdfunding: The New Venture Capital

Investment in crowdfunding platforms may surpass venture capital funding in 2016. Popular sites Indiegogo and Kickstarter have helped thousands of ideas get off the ground – from bizarre video games to social projects and multi-purpose jackets, small businesses and entrepreneurs can now look to the general public for support. Countless other sites such as GoFundMe, which took off by bootstrapping, allow individuals to raise money for any project they like.

A ‘Bankless’ World

The headline of loan refinancing startup, SoFi’s website reads, “Great news: we’re not a bank.” Over the past few decades, we’ve seen a general distrust and loss of confidence in our traditional banking system, dominated by the big banks. After the Global Recession in the late 2000s, a new generation of startups hopes to fix the transparency issue facing big banks and provide consumers with more personalized and comprehensive services online.

Nasir Zubairi, venture partner at FinLeap in Berlin, commented on the FinTech industry, stating that “3 billion people, 50% of the world, do not have access to a banking system, and I think that FinTech can help in solving the problem around credit. There’s a huge opportunity for FinTech companies and of course for people who will benefit from their solutions.” Startups such as Kabbage, a small business lender, take into account a myriad of factors such as eBay data into account when determining risk, providing more of a data-driven service unhindered by the same regulations that restrict the traditional banking system. Countless other platforms such as CreditKarma offer credit risk services at zero or low cost.

Democratizing Investment Products and Services

Robo-advisors continue to gain traction as a provider of investment services once solely accessible to wealthier individuals who could afford their own financial advisor. An online advisor is now available through multiple platforms such as Wealthfront and Betterment. Wealthfront manages your first $10,000 free for a small fee of .25% after that while Betterment charges .35% to .25% annually or $3 per month. A series of questions, including an individual’s age, determines a user’s risk tolerance, which then determines the portfolio allocation for each specific individual. If you are unwilling or unable to invest your money yourself, or through a trusted financial advisor, an online platform is a much better way to direct your savings to their most effective use.

FinTech startups aren’t stopping at stock investment, however. For the growing number of Americans who seek involvement in alternative investing and philanthropic projects, the FinTech industry continues to deliver. Take Neighborly, a social venture helping you get involved in the municipal bond market. Neighborly’s Community Investment Marketplace allows you to make an impact directly in your community through safe and lucrative investing.

Budgeting: A Virtual Piggy Bank

As many tech startups target millennials, there’s a significant opportunity for business to facilitate the process of a new generation beginning to save, lend, and invest their money. Millennials don’t simply want to watch the purchasing power of their money wither away in a bank account; instead, they’re using budgeting and educational platforms to help them with a financial strategy. Alongside their robo-advisors, individuals can use budgeting platforms such as LevelMoney and Acorns that automatically track spending and income to give users a daily allowance for the day. This helps people grasp exactly how they are spending their hard earned dollars. Other platforms find creative ways to save you a dime. For example, Paribus scans users emails for receipts following a purchase to get money back in the case of a price drop.

The Bottom Line

FinTech is on the fast track to growth, and it’s not just investors who can benefit from the success. Be sure to stay up to date on the rapidly evolving FinTech sector, which will help drive a democratization of financial tools and services, from payments to wealth management and philanthropy. Ultimately, whether FinTech will take the place of traditional banking entirely is up for debate. However, the plethora of cost efficient and accessible financial tools and services will undoubtedly force the entire financial sector to transform.

Credit: Investopedia & JumpFon.com

Top Stories

Short Code – The Definitive Guide to Mobile Messaging & Marketing

February 9, 2016 | 4-minute read

“Text HOT to short code 1901 for the best music from your favourite artistes on your phone!”

“Be the first to know! Text NEWS to 1944.”

“Win airtime every day! Text FREE to 1902.”

You have most likely seen hundreds of these text messaging campaigns or heard about them, but wondered what these funky 4 or 5 digit numbers are, or where they come from.

Well, here’s your answer.

They’re called Short Codes.

As an individual or business, reaching out to friends, clients and customers in the most personal way – their mobile phones – should be of great interest to you. These days, more organizations and businesses are turning to short codes as the backbone of their SMS messaging and marketing campaigns, as they have realized that text message marketing is a very quick, inexpensive, and more productive way to reach their customers (or potential customers).

Short codes have also been made more popular in the last few years by a number of television shows that allow viewers to text a message to a short number. Examples include viewers sending a text message to a short code to vote for their favorite contestant of a reality TV show, or to make a charitable donation.

What is a Short Code?

An SMS short code is short numeric number (typically 4-5 digits) that is used to opt-in consumers to SMS programs, and then used to send text and multimedia messages, offers, promotions and more, to those customers that had previously opted-in. A consumer interacts with an SMS short code by composing a new text message on their mobile device, and addressing it to the SMS short code. In the examples below, the SMS short codes used are 1901, 1944 and 1902.

SMS Keywords

When a customer wants to opt-in to an SMS campaign, they’ll not only need to know the SMS short code, but they’ll also need to know the SMS keyword for that specific campaign. The SMS keyword helps a provider like SMSGH determine which SMS campaign the consumer is trying to opt-in to. Once received, the SMS provider routes the message through the SMS software, which then would send back a confirmation text message to the subscriber who originated the message. In the first example above, the SMS short code used by this business is 1901, and the SMS keyword is “HOT”.

Here are five things to appreciate about short codes, and how and where to get them.

1. An SMS short code service is one of the quickest and most effective ways to get your marketing campaign off the ground.

2. SMS marketing enables you to engage your prospective customers at the point of display, and you can quickly generate sales leads using SMS marketing. Wireless subscribers send text messages to common short codes with relevant keywords to access a wide variety of mobile content.

3. There are two kinds of short codes: shared and dedicated. Dedicated short codes are owned and managed by one body, are costly and take a while to set up. In Ghana it can cost anywhere from GHs5,000 to GHs7,000 per year and take up to 72 hours to get ready. Click here to get more info.

4. Shared short codes are used by many different bodies. Each business sharing a short code would be assigned a unique SMS keyword, which helps an SMS provider like SMSGH determine which SMS campaign a user is trying to opt-in to. The cost involved in setting up a shared short code is less than that for a dedicated short code.

5. If you text STOP or HELP to a short code, the service would respond. This is implemented to help users respectively end a subscription or learn more about the short code service, and is useful for managing these services.

Can’t wait to see what you can do with short codes? Get started today. Talk to a sales expert now. Or see short code pricing here.

Top Stories

What You Need To Know To Run A Successful SMS Marketing Campaign

February 4, 2016 | 10-minute read

If you haven’t started looking for ways to add Short Messaging Services to your marketing mix, now is the time.

Yes, I know apps are the craze these days but we’re still at about 15% smartphone penetration in Ghana.

That means there may still be a lot of your customers that don’t have smartphones. Also, just because they have a smartphone doesn’t mean they use it for all that it’s capable of. Just ask my dad—he has the latest and greatest of phones at all times and all I get from him are texts with photos of my niece.

One of the greatest things about SMS is that nearly 100% of all devices on the market are SMS enabled, making it the mobile channel that offers the widest reach possible.

Some of the top brands invest heavily in SMS today to communicate with customers because over 90% of SMS messages are read within 3 minutes of receipt.

Yes, that immediate!

In fact, it’s been reported that Coca-Cola historically has invested 70% of its mobile budget in SMS marketing.

When asked why, Tom Daily, the Director of Mobile, Search, and Global Connections replied, “It is important to invest your energy into things you know work, and we know that SMS works and is a thing to focus on.”

In addition to its reach and immediacy, SMS is very affordable and offers an amazing ROI for marketers when used properly.

If you’re ready to dive into SMS marketing and leverage this amazingly powerful channel it’s important that you’re set up for success and not just using mobile for mobile sake.

- Understand Your Goals

When diving into mobile marketing, it’s common to approach it as its own initiative.

That’s typically the worst direction to take.

Businesses that approach mobile as a silo will almost never get the results they were hoping for or even expected.

Before diving into your execution, it’s wise to review your business and marketing goals so that you’re creating your SMS campaign through a lens that takes your current business goals into account.

Having S.M.A.R.T goals (Specific, Measurable, Achievable, Relevant, and Time Specific) will assure your SMS campaign is executed in a way that meets your objectives.

It’s important to understand that your SMS campaign will likely impact many parts of your organization, so communicating your goals and strategy clearly throughout the organization is critical.

- Build An Ark

Your SMS mobile campaign will impact many departments of your company. Having a cross-functional team to help conceive and operate the SMS programs will be one of the most important parts to winning with SMS.

For example, let’s say you’re building a mobile loyalty list to drive customers to retail.

Having led the mobile efforts for Cabela’s previously, I know very well just how many people this type of effort can impact.

We had a cross-functional team that included members from teams responsible for retail, in-store signage, digital creative, email, IT, social media, promotions, and the discounts budget, as well as two external teams.

Build out your ark and make sure everyone is on the same page when it comes time for execution.

- Clear Call-To-Action

One of the most common reasons SMS campaigns fail is that the call-to-action isn’t presented in a way that the consumer recognizes or understands what to do.

Take this example from Pepsi. They tell consumers to Text “PEPSIMAX” to 710710.

Having been involved in SMS since 2005, I can tell you that a significant amount of people probably texted with quotations around the keyword, which actually doesn’t trigger the campaign.

SMS campaigns are driven by two factors – the keyword and a short code. In this example, PEPSIMAX is the keyword and 710710 is the short code.

It’s common and best practice to capitalize the keyword and shortcode to make them stand out within the call-to-action.

One thing Pepsi is doing really well here is making the SMS call-to-action the focal point of the creative. I’ve found SMS CTA’s in the fine print far too many times.

If you want to drive engagement, give your SMS CTA the priority it deserves.

For instance, JumpFon, a premium content provider employs this catchy creative banner to advertise its Lifestyle content services.

The call-to-action is bold and straightforward, well highlighted by the difference in color to draw emphatic attention to the focus of the banner, which is the Keyword and Shortcode.

This presents the message clearly to users avoiding any ambiguity in the expected action to take to subscribe to the service.

- Leverage Incentives

Let’s not kid ourselves. Our mobile device is one of if not the most personal device we have. The consumers that welcome you into their phone, especially through SMS, should be considered some of your most loyal customers.

With that said, you want to treat your most loyal customers with some extra love, and a great way to do that is to incentivize customers to opt in by giving something of value.

Typically, you’ll see brands doing a percent off or dollar off coupons to save a few bucks.

In the early stages of your SMS campaign, as you’re building your list, starting with a low-value offer (say up to $20 off) can really help drive opt-ins and spark your initial list growth.

Once you’ve got people opted-in, you can leverage “spend and get” campaigns or “Buy One Get One” campaigns (also known as BOGOs).

I personally love “spend and gets” because they can really help you increase your average order value (AOV) while self-funding the campaign (great when your discount budget is super tight).

Let’s look at an example:

Say your AOV is $100.

Sending an SMS message to your database with an offer: “Get $20 when you spend over $150” can be really effective.

A customer will come in and be inclined to spend $50 more than they usually do knowing they’ll get back $20.

For the sake of the example, let’s say they spend $150 exactly.

You’ve just increased your AOV by $50. When you give the customer their $20 voucher, you’re left with a $30 incremental lift for that customer.

Multiply that by the soon-to-be hundreds, if not thousands of people that redeemed your offer, and you just drove some significant revenue with one message.

Now remember, incentives don’t always have to be monetary.

I know a lot of brands that are not “discounters”. I worked for one of them.

You can still have an effective SMS campaign by offering non-monetary incentives.

Your non-monetary incentives can focus on:

- Personalization – “We’ll notify you when your favorite item comes in.”

- Reminders – “Your shipment will be delivered today.”

- Engagement – “Tell us how we can help you.”

- Access – “Here is early access to this special thing just because you’re a loyal SMS subscriber.”

- Privileges – “Here is this special thing we only share with our SMS VIPs.”

Try incorporating your incentives in your call-to-action from number three and really drive opt-ins.

- Permission Is Required

Just like email, SMS is a permission-based opt-in channel.

Your customer needs to clearly opt in to receive what you’re offering.

This can happen in one of two ways:

- By texting a keyword to a short code (such as the Pepsi and JumpFon example from above), or

- By submitting their number via a web form.

Either way, it needs to be obvious the customer has consented to receive these messages.

You can’t just look through old customer records and add mobile numbers to your database and then message those customers.

- Leverage Immediacy

Over 90% of SMS messages are read within 3 minutes.

That makes SMS one of, if not the most immediate channel available to connect with your audience.

Understanding this immediacy is important to your success and driving customer action.

If you have an event on Friday evening, sending an SMS message any time before Thursday evening is too soon.

With your messages guaranteed to reach your customer and disrupt whatever it is they are doing, it’s important that you aim to deliver extremely high value via a very clear and concise call to action.

Since SMS messages only allow for 160 characters (some of which require your compliance language from above) it’s important to be short, sweet, and to the point.

- Consistency

One of the biggest mistakes businesses make when using SMS is not sending messages consistently enough.

Like any other aspect of marketing, you should be leveraging any marketing or promotional character at your disposal. If there isn’t one, you should be sure to create one and use that as the foundation for your messaging calendar.

When it comes to messaging your customers, you obviously want to have something of value to say within each message, but going months without connecting via SMS is likely going to cause a high unsubscribe rate with every send.

Some of the most successful businesses leveraging SMS today, such as Starbucks, Target, Macy’s, and JC Penney, are sending at least one message a week to stay at the top of the minds of their customers.

- Media Integration

In general, mobile is one of the most dependent marketing channels that exist. When it comes time to promote your SMS program and drive adoption, it’s important to leverage all of your existing media outlets, whether that’s TV, radio, print, in-store signage, online, social, email, etc.

Performing an audit of your existing media assets to identify where you can integrate your SMS calls-to-action will help align you with the right teams to make sure the creative development process includes SMS integration.

Remember, you’ll want to make sure the SMS CTA is clear and easy to read—not buried somewhere in the signage.

Your goal isn’t to check a box by having an SMS CTA integrated within your existing media; it’s to extend the reach and interactivity of your existing media and create an opportunity for continued engagement.

Performing an audit will identify all of the media outlets to integrate your CTA so that you can be on the same page as the rest of your cross-functional team.

- Measurement

The only way to determine if your SMS campaign is successful or not is by measuring.

When it comes to SMS there are a handful of things you can do from a measurement perspective. The great thing is that they are all fairly easy to manage. Here are a few metrics to follow when executing an SMS campaign:

- Subscriber Growth: Monitor your growth rate each week and identify which activities make the list grow.

- Subscriber Churn Rate: This is the frequency at which people are opting out of your SMS program over time. Ideally, your program never goes over a 2-3% churn rate.

- Cross Channel Engagement (by keyword): By using different SMS keywords within different media outlets, you can quickly measure which types of media and media locations are performing best and optimize based on engagement.

- Redemption Rate: This is something you’ll monitor on a campaign-by-campaign basis (or by message) to determine the percentage of customers that redeem your offers and what rates.

- Cost Per Redeeming Subscriber: From the redemption rate, you can determine the cost of communicating with each customer that receives your SMS messages.

When it comes time to plan and launch your next SMS marketing campaign, be sure to account for these 10 components and you’ll be well on your way to a successful SMS marketing campaign.

Have you tried using SMS yet in your business? If so, have you seen success? If you haven’t started, are you thinking of giving it a shot? Sign up for business messaging tools on MYtxtBOX.com.

Original story found at convinceandconvert.com

Top Stories

How Can Companies Catch The Digital Wave?

January 26, 2016 | 5-minute read

Technological change has always posed a challenge for companies. But, as we saw once again in 2015, it has never occurred as rapidly, or on as large a scale, as today. As innovation sweeps across virtually every sector, from heavy industry to services, it is transforming the competitive landscape, with the most advanced companies – rather than the largest or most established players – coming out on top.

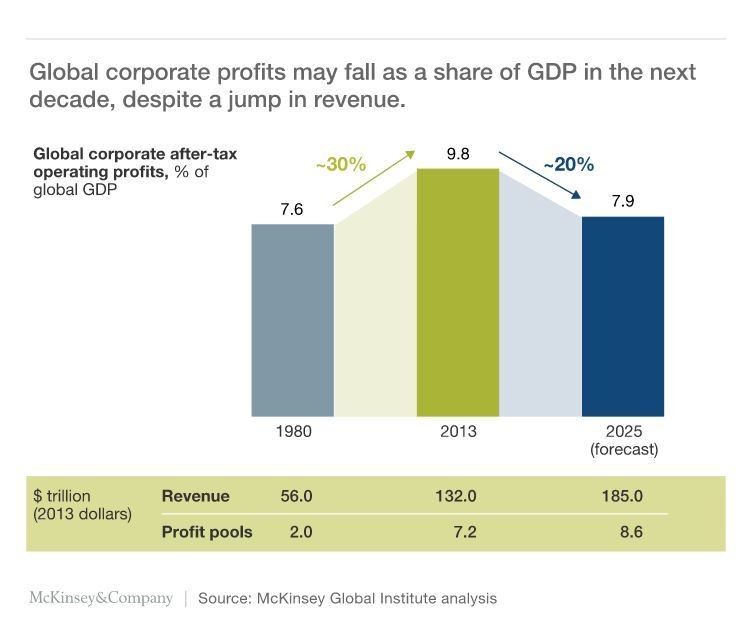

For incumbents, the threat of displacement is very real. The average tenure of a company on the S&P 500 has fallen from 90 years in 1935 to less than 18 years today. Disruptive new players like Uber, which has upended the taxi industry, are tough competitors, often staking out market share by shifting more surplus to consumers. This is part of a broader trend of intensifying competition that, according to recent research from the McKinsey Global Institute, could reduce the global after-tax profit pool from almost 10% of global GDP today to its 1980 level of about 7.9% within a decade.

The effect of technology on competition arises largely from the power of digital platforms and network effects. New digital platforms reduce marginal costs (the cost of producing additional units of a good or service) to nearly zero. Adding, say, a Google Maps user carries negligible costs because the service relies on GPS location data that is already stored on a user’s phone. This allows Google to scale incredibly quickly, and then to leverage this scale (and the convenience of having a single platform) to move into adjacent sectors – such as music (Google Play), payment (Google Wallet), and word processing (Google Docs). In this manner, tech firms can quickly come to challenge incumbents in seemingly unrelated industries.

Of course, tech firms are not the only ones innovating. A handful of leading firms in practically every industry are deploying digital technology in increasingly sophisticated ways – and seeing huge benefits. The use of sensors to monitor livestock, for example, has far-reaching implications for the food industry.

But the most digitally advanced sectors show the greatest progress. Indeed, over the last 20 years, profit margins in these tech-infused sectors have grown 2-3 times faster, on average, than in the rest of the economy. Even within the most advanced sectors, there is a yawning gap between the top-performing companies and the rest of the pack. For example, the retail offerings of digitally advanced multinational banks far outstrip those of local credit unions.

As technology transforms business models and processes, it is also changing the way employees work. Recent McKinsey research finds that already-proven technologies could automate as much as 45% of the tasks individuals are currently paid to perform. In the United States alone, that is the equivalent of about $2 trillion in annual wages.

The potential benefits of this transformation for companies extend far beyond cost savings, as workers gain time to pursue more valuable tasks involving critical thinking and creativity. Financial advisers can spend less time analyzing financials and more time developing solutions that meet clients’ needs. Or interior decorators can shift their attention from taking measurements to devising design concepts, meeting with clients, or sourcing materials.

Technology also allows companies to rethink conventional wisdom on organizational design and governance. New information-sharing technologies deliver greater transparency, making organizations more efficient and, in many cases, less hierarchical.

For example, the CEOs of Apple, Inditex (a multinational clothing company), and Zappos (a large online retailer) have adopted broad spans of control (the number of subordinates directly reporting to a manager) that far exceed the traditional model of “one to four to eight.” Haier, the Chinese white goods manufacturer, reorganized its 80,000-person workforce into 2,000 independent units, each responsible for managing its own profits and losses. Since the move, its market capitalization has soared, tripling from 2011 to 2014.

Moreover, digitization allows companies to operate as “platforms,” not structures, and make greater use of resources outside their company. The insurance company Allstate used the crowdsourcing platform Kaggle to invite programmers to develop a new car accident injury algorithm; the eventual “winner” was 271% more accurate than its existing model.

Likewise, China’s DJI became the world’s largest drone manufacturer by focusing on its products’ core technology, while giving away developer kits for free online so that others could build apps. This approach meant that DJI’s drones were equipped with attractive features far earlier than competitors’ products, which relied on in-house app development.

Similar technology-driven innovations in thought processes and business models can be seen across the economy, reflected in changes in companies’ planning processes. Some have begun creating separate business plans with two-month and 20-year views, reallocating their resources more aggressively, and using new analytical techniques to identify, attract, develop, and retain talent.

Technological innovation enables – indeed, requires – companies to boost their agility and thus their competitiveness. That’s why CEOs’ top priorities in 2016 should be to digitize the core components of their business and rethink organizational design and governance processes. Catching this fast-moving – and rapidly growing – “digital wave” is the only way to avoid getting left behind.

Author: Dominic Barton is the global managing director of McKinsey & Company.

Source: weforum.org

Top Stories

Content Partners Meet MTN Ghana CEO

December 23, 2015 | 2-minute read

2015 has been an exciting year at SMSGH in many ways. With the launch of JumpFon Stream, MYtxtBOX.com’s extension to include voice messaging, the celebration of its tenth anniversary, and the growth of the SMSGH team across Ghana, Kenya, Cameroon, and Nigeria, the company is making strides to deliver topmost services to customers.

The year got even more exciting on Friday 18th December 2015, when SMSGH once again reaffirmed its position as a leading brand for technology, value addition, and market acceptance with its recognition as the Overall Best Performing Content Provider and the Top Contributor at the 2015 Meeting with the CEO, organized by MTN Ghana for all Value Added Services (VAS) partners operating via the network’s infrastructure.

The afternoon commenced with an overview of the performance of the VAS business division led by the MTN VAS team. Chief Marketing Officer of MTN Ghana, Cynthia Lumor, led another session on corporate and legal regulations surrounding the provision of content services. She also touched on the outlook for new regulations in the coming year, reminding players in the VAS industry of the importance of strict adherence to NCA guidelines and urging their cooperation in ensuring fairness among providers as well as the protection of consumers. Then followed a review of top performing Content Providers within the 2015 business year.

While we are extremely honored by these prestigious awards, we are even more delighted by the opportunity to enable our customers’ success. SMSGH recognizes the role users played in reaching this level of performance. In this light, the company dedicates the award to its current user base who have remained loyal in patronizing the top services offered.

Partner Sales Manager of SMSGH, Nana Kwame Adu-Gyamfi, summed it up well, saying, “Winning the VAS provider of the year award is a nice way to round off a year in which we had a number of significant milestones. Thanks to our customers for their trust in SMSGH in 2015. We look forward to working together to support their growth in 2016. Thanks also to everyone at SMSGH for all of their hard work in making all of this possible!”

Top Stories

MPower Season Rewards

December 14, 2015 | 2-minute read

MPower is saying welcome to its new customers in a special way this holiday season. by giving away GHS5.00 free for the first wallet top-up. This means any customer who opens an account on MPower will receive GHS5.00 upon topping up their account for the first time.

MPower is an online payments service in Ghana offering a complete end-to-end web and mobile payment transactions solution to enable consumers and businesses send, spend and receive money. The aim is to redefine payments and transactions in Ghana by empowering businesses and consumers to do more with their money conveniently.

MPower has integrated with major local ecommerce merchants to enable users buy and pay for goods online from the comfort of their homes and offices.

To cash in on this offer, users only need to create an account and top up their wallet with mobile money, bank deposit or debit card.

Creating an account on MPower takes 4 simple steps:

1. Go to www.mpower.com.gh.

2. Click Create an account to sign up.

3. Complete the form and submit

4. Activate the account with the activation code sent to your phone.

With many ways to spend money on MPower one can shop from their favorite online shop, buy airtime and pay bills from the MPower CornerShop. Fees and charges that apply per the various transactions performed are listed on the MPower Service Fees page.

The offer started on 10th December and the first 2000 users to sign up and top up will be receiving the GHS5.00 in their accounts to spend.

Visit MPower today at www.mpower.com.gh or simply dial *714*44#.

MPower is saying ‘Be MPower’ed’ this festive season!

Top Stories

SMSGH At The MTN Career Fair 2015

December 10, 2015 | 2-minute read

The MTN Career Fair is an initiative by MTN Ghana to bridge the career guidance and counseling gap for graduates and final-year students and also assist them in their search for employment. Since its inception in 2013, the fair has been held annually and this year’s event took place at the National Theatre on the 9th December, 2015, from 9am to 4pm.

The event was patronized by thousands of students and unemployed graduates as well as companies from various industries in search of the best talents to occupy available positions in these firms.

The fair opened with a welcome address from the Chief Marketing Officer (CMO) of MTN, Noel Ganson, who said it was a platform for students and young graduates to acquire the knowledge and the necessary empowerment needed to start a professional career and to meet the challenges of a dynamic corporate world.

A key highlight of the event was a presentation on career planning by Ama Benneh, Human Resource Director of MTN; registered participants received guidance on how to write compelling CVs and prepare for job interviews.

Other notable speakers present at the fair included the host of Accra-based Citi FM, Bernard Avle, seasoned speaker, Emmanuel Dei-Tumi, respected author, Comfort Ocran, and the Head of Research and Engineering at DreamOval, Henry Sampson.

Attendees also had the opportunity to meet recruitment agencies and prospective employers for job interviews during the fair.

SMSGH was present at this year’s event to interact with job seekers and to find the relevant talent to join the team.

SMSGH sought various skilled individuals to fill positions in its Technology, Sales, Marketing, and Operations departments. These roles specifically include software development, customer support, copywriting, visual designing, and event management.

Details on open positions at SMSGH can be found on the careers page on the website. Interested candidates who qualify for these roles may apply directly on the page or submit their CVs to [email protected].

Top Stories

MYtxtBOX Releases New Instant Top-Up Option Via USSD – *714*22#

December 9, 2015 | 2-minute read

MYtxtBOX has just introduced a new way to top up credits via USSD. This additional top-up option offers users an effective means of purchasing MYtxtBOX credits with mobile money specifically through MTN and Airtel mobile wallets.

MYtxtBOX offers various mobile communication options for brands, businesses, and consumers to engage with their customers and contacts via text, multimedia, and recently voice messaging options.

MYtxtBOX provides a host of options for users to top up credits on their accounts. Before now customers could top-up via 5 main options:

- Direct bank deposit

- Direct mobile money deposit

- Purchasing top-up credits vouchers

- Credit/debit cards

- Payment via MPower

With this new top-up option, users can now perform 2 key functions on the go:

- Check their existing balance

- Top up an amount via Airtel Money or MTN Mobile Money

The top-up process can be completed in 5 simple steps:

- Dial *714*22#.

- Follow the USSD prompts.

- You will receive a payment bill prompt on your phone.

- Enter your mobile money pin.

- Follow the prompt to accept the payment request.

Logging in to MYtxtBOX after this process indicates the new credit balance at the top right corner of the page.

The key benefit here is the ease of the process. It can take place on nearly every phone and does not require internet connectivity. This allows for convenience and a great deal of time, money, and effort is saved. Businesses and consumers can now enjoy the comfort of directly topping up their messaging credits with their mobile devices regardless of location and timing.

Top Stories

Africa’s Digital Banking Boom – Clients Are Winning

December 8, 2015 | 4-minute read

Five years ago, banking clients in Nairobi had to spend an hour queuing to pay their utility bills. Fast forward to the present day, and these clients can now pay their bills at the touch of a button from the comfort of their home.

The digital economy is creating a watershed moment for the banking industry, and – in many ways – clients in Africa are at the forefront of these changes with their widespread adoption of mobile phones.

High expectations

Across the globe, increasing numbers of people are now accessing financial services from their mobile devices, their expectations set to ‘high’ by digitally native technology players, like Alibaba and Apple.

Client loyalty is built on ease of use, security, 24/7 access and a fuss-free user experience. In banking, it’s about clients being offered the most relevant savings and credit cards, based on their past usage. For example, if you have just received a bonus and are looking to grow your wealth, you will want to be offered an investment product that fits your risk profile.

The lesson for banks is clear: value your interactions with clients – especially via digital channels – and invest in data analysis. Clients will be loyal to a bank that knows them and makes banking convenient and easy.

The race to deliver the best digital client experience is particularly intense in Asia and Africa, where a new generation of young, affluent clients are coming to the fore. The number of middle class households in key Sub-Saharan African countries is set to grow rapidly. These households will be digitally savvy and more likely to embrace new types of financial service providers, including those outside the banking industry.

The future is here

In the past five years, Sub-Saharan Africa has been the fastest-growing region in the world for mobile telephony, paving the way for a proliferation of mobile wallets. In Kenya, around 18 million adults, or 85 per cent of the population, now use mobile money services, such as M-Pesa, Mobikash or Airtel money.

When it comes to digital banking in Africa, things are changing fast too. Imagine sitting in a taxi in Lagos traffic: you log on to your mobile device, and see all your banking activities at a glance. You have a question about what investment options are available to plan for your future, so you press a button to talk to your relationship manager. Via video, your relationship manager links you to an investment advisor, who answers all your questions and gives you options that meet your needs. This will be the norm not too far in the future.

Clients are expecting banks to reverse the service pyramid: instead of being offered digital channels incrementally, they want to receive all services digitally in the first instance.

At Standard Chartered, we are changing our business model fundamentally, to be ‘digital by design’, but we acknowledge that to move nimbly and bring more convenience to clients, we need to partner financial technology companies in niche areas.

In Africa, we have teamed up with mobile payments aggregators, such as Selcom in Tanzania, Cellulant in Kenya, Zambia and Botswana, and eTranzact in Nigeria and Ghana, to enable bill payment on mobile from our clients’ bank accounts; client transactions via this channel are increasing by over 50 per cent annually. We have also made it easier for our corporate clients to make mobile-wallet payments to individuals, whether or not they have bank accounts through our Straight2Bank Wallet mobile app.

Banks need to jealously guard their reputation as trustworthy counterparties and custodians – virtues that are increasingly valuable in a digital economy beset with trust and privacy issues.

There are challenges to getting it right, but the good news for clients in Africa is that they are certain to be the big winners as banks invest to understand and serve them better.

By Karen Fawcett, CEO (Retail Banking, Standard Chartered)

Top Stories

10 Ways To Make The Wi-Fi In Your House More Powerful

December 8, 2015 | 5-minute read

Fairy lights on Christmas trees can cause slower broadband speeds, according to Ofcom.

The communications watchdog says wireless networks in homes and offices are often set up incorrectly or they’re suffering from “interference” from electronics with wiring like baby monitors and things like microwaves.

Ofcom has launched a free app called Wi-Fi Checker which allows you to test the quality of your signal and ways to make it better.

Here’s our 10-point guide to making your signal strength stronger.

1. Upgrade your router

The routers that come with your broadband packages are fairly decent these days.

But if you want a really fast wi-fi connection at home, why not ask for a new router for Christmas?

The latest bits of hardware will make your broadband go further and perform better.

2. Move your router

Probably best to make sure your router doesn’t have a plant on it

This may be common sense to some but the higher up, the better.

So put your router on the top floor of your house if you can, on top of furniture and near the middle of the house. And keep it off the floor if you want a decent signal.

But you’ll obviously have to think about how practical that may be as the router needs an Ethernet cable, power, and/or coax.

3. Change the channel on your router

This one’s a bit more technical, but most routers these days come with dual bandwidths (look in the booklet your hardware came with).

Basically – most routers run on the 2.4GHz frequency – but so do many other household appliances like microwaves, baby monitors, Bluetooth, CCTV, and cordless phones.

If you change to the 5GHz frequency you should have less interference. Your neighbor will also probably still be using 2.4GHz as well, so that’s one less source of interference – or in this case “contention”.

4. Cut down on interference (attenuation)

Lots of things can affect your Wi-Fi signal, which is why Ofcom mentioned fairy lights.

Make sure your cat doesn’t interfere with your signal either…

But any electrical cable can have a negative impact if they’re in the way – as can metal doors, aluminium studs, wall insulation, water (fish tanks, etc), mirrors, halogen lamps, filing cabinets, brick, glass and concrete.

Anything that affects signal strength is actually called attenuation – just so you know.

5. Update your software

Make sure your router has the latest updates.

Software is improved constantly plus the newest mobiles and laptops will obviously connect at higher speeds to a stronger wi-fi signal.

More important though is what’s called Signal to Noise Ratio (SNR) which will actually determine the data speeds at which a device will connect.

Just because you can see five bars on your device doesn’t mean you’re guaranteed high data rates.

6. Think about extenders

Extenders work by pushing your existing signal further. You can use older routers to do this for you, but it’s a bit technical to hack into them.

The easiest thing to do is to buy an extender, or even better, use powerline technology.

That’s when you plug an adapter into your mains sockets and the Wi-Fi is amplified using the electrical wiring in your walls.

Probably best not to use the household wiring if it looks like this though…

Also, if you have an older router with antennas, you can buy better ones.

7. Share with your neighbours?

If you live in a block of flats and get on with your neighbours, you could share a shiny new router.

That way the person at the top of your block (see point two) could beam Wi-Fi into the rest of the building and you share the cost. But if you live at the bottom you may get a weaker signal.

You could also use your phone or laptop as a hotspot or get MiFi.

If there’s someone using lots of bandwidth in the house (we’re thinking gamer or heavy video streamer), you can also use Quality of Service to prioritise what gets the best Wi-Fi signal.

8. Secure your wi-fi

If you don’t like your neighbours, or if you just want a more secure network, use a different Wireless Security Protocol – WPA/WPA2 instead of WEP (this is quite complicated but basically just search for your router online and ask the web how to change it).

Quiz fact: WEP is Wired Equivalent Privacy and WPA is Wi-Fi Protected Access.

You can also limit the number of devices your wi-fi will support with something called MAC addresses (media access control addresses). Again there are lots of self-help guides online.

9. Don’t publicise your signal

You know when you search for public wi-fi and it comes up with lots of options (depending on where you live obviously)?

Well, if you haven’t secured your network, other people can obviously use your wi-fi signal.

You can make your network private by adding a password but you can also make it even more secure by going to your administration page and unchecking “Enable SSID Broadcast”.

This will take your signal off most people’s wi-fi smartphone lists but there are apps that can find your “hidden” signal.

10. And if all else fails… use tin foil

This one’s a bit more left field, and seemingly unproven, but seems to work sometimes.

Just get some tin foil from your kitchen, curve it around the back of your router, and away you go.

You may want to download a free Wi-Fi speed-checking app to test signal strength before and after.

People have also used a variety of other metal objects behind their routers from beer cans to sieves and graters. We’ll leave that one up to you.

Credit: BBC Newsbeat

Top Stories

MPower Rewards Users Weekly With GHs100 Tokens

MPower Payments is rewarding users for their loyalty in using its payment services. To achieve this, MPower will be giving out rewards in the form of funds to several account owners.

MPower is an online payments service in Ghana offering a complete end-to-end web and mobile payment transactions solution to enable consumers and businesses to send, spend and receive money.

The rewards have been packaged as a standard amount of GHs100 for selected users who keep an active MPower account. The goal here is to reward active users hence the selected user must have completed at least two transactions within the week of selection.

Transactions performed on MPower currently take place in 3 main ways:

- Users transfer/send money or tokens to other accounts including MPower, bank, and the various mobile wallets of local network operators.

- Users also make payments to merchants:

- Purchasing products from online stores that have integrated MPower as a payment option.

- Paying for services from providers who accept remote payments via MPower.

- Purchases on MPower CornerShop:

- Airtime top-ups for all networks

- Internet bundles purchases

- Utility bills payments

- Vouchers vended by services

Users can also initiate another transaction type by making requests to other account owners via PayPal, mobile money wallets, and MPower tokens using the receive money feature on MPower.

Fees and charges that apply per the various transactions performed are listed on the MPower Service Fees page.

The giveaway/offer, which began on October 30, 2015, is set to run weekly till the end of December this year; coinciding with the gifting tradition of Xmas and New Year holidays.

Selections will be made each Friday and payouts will occur instantly to furnish the recipient’s MPower account with the reward. This amount can be spent in the same way as regular funds on MPower.

The MPower service is accessible via web at www.mpower.com.gh and also via mobile on MPower’s android application.

Top Stories

Ghana Ecommerce Expo 2015 held in Accra

November 11, 2015 | 1-minute read

The second Ghana eCommerce Expo was officially opened today, 10th November 2015, by the Deputy Minister of Communications, Hon Felix Kwakye-Fosu. The theme for this year’s conference is: “Unleashing Ghana’s Online Potential” and the event is scheduled to run for two whole days at the Accra International Conference Centre.

Organized by OML Africa, the Ghana eCommerce Expo is a prestigious event for the online business industry.

Over 40 exhibitors made up of eCommerce websites, digital payment providers, software developers, telcos, etc are displaying their cutting-edge solutions to the burgeoning Ghanaian eCommerce market.

The conference running the exhibition is being addressed by 18 experts in the eCommerce industry. Speakers include Haris Broumidis(CEO, Vodafone); Cherian Mathew (V Partner, QNET); Sandra Owusu-Kyerematen (Country Manager, Tonaton); and many other reputable luminaries in the field.