Tag: Feature Story

Hubtel, Ghana’s first full-feature quick commerce platform, is celebrating its 18th anniversary as a trailblazing, wholly-managed Ghanaian tech company. From its inception in 2005 as SMSGH, the company has undergone a remarkable transformation, evolving from being the primary SMS solution-based messaging business to a fully licensed payment and digital transformation services provider. Upon reflection, a lot has been achieved over the past 18 years, however, it is the company’s ability to embrace and overcome failure that has been crucial to its growth and success.

The Hubtel Story

In 2005, two bright and ambitious undergraduates from the Kwame Nkrumah University of Science and Technology, Alex Bram and Ernest Apenteng, set out to revolutionize how businesses connect with their customers through SMS messaging. Thus, SMSGH was born. Armed with an entrepreneurial inquisitiveness that was strange for Chemistry and Biological Sciences majors at the time, Bram and Apenteng faced challenge after challenge along the way to achieving success. As secondary school students, the duo ventured into various business endeavours such as magazine production, facility management, and event management. While some of these initiatives saw a modest level of success, most were unable to withstand the test of time. Nevertheless, these experiences served as a wellspring of knowledge for the young entrepreneurs.

Driven by their vision to establish a successful company, that not only provides employment opportunities but also delivers innovation, value, and impact to society, Bram and Apenteng poured their hearts into SMSGH. Five months after launching, the company recorded its first sale, and within three months, it had secured contracts with leading firms in Ghana worth approximately USD 6,000.

By 2007, SMSGH had already launched one of Africa’s first online SMS messaging portals and transactional alert systems for banks in Ghana. The company’s revenue grew to an impressive USD 1 million by the end of the 2007 financial year. In 2011, SMSGH solidified its position as Ghana’s largest messaging services provider after introducing a micro-billing platform that processed payments via subscriber airtime balances. In recognition of their ground-breaking achievements, Forbes Africa Magazine named SMSGH one of the Top 20 Technology Start-Ups in 2012.

SMSGH to Hubtel

By 2013, SMSGH had already established itself as a thriving company. The following year, investor interest in the business soared, resulting in numerous offers of investment. However, the team made a bold decision to turn down these offers, committed to maintaining the company’s Ghanaian roots.

SMSGH’s first financial year, 2007, was a remarkable success, all things considered. Good times continued to roll and between 2010 and 2011, the company saw a staggering 230% increase in revenue, with annual growth rates of over 100%. However, in 2013 and 2014, the growth rate slowed to about 30%, and by 2014-2015, it had further declined to 20%. This served as a signal that it was time to pivot the company in a new direction.

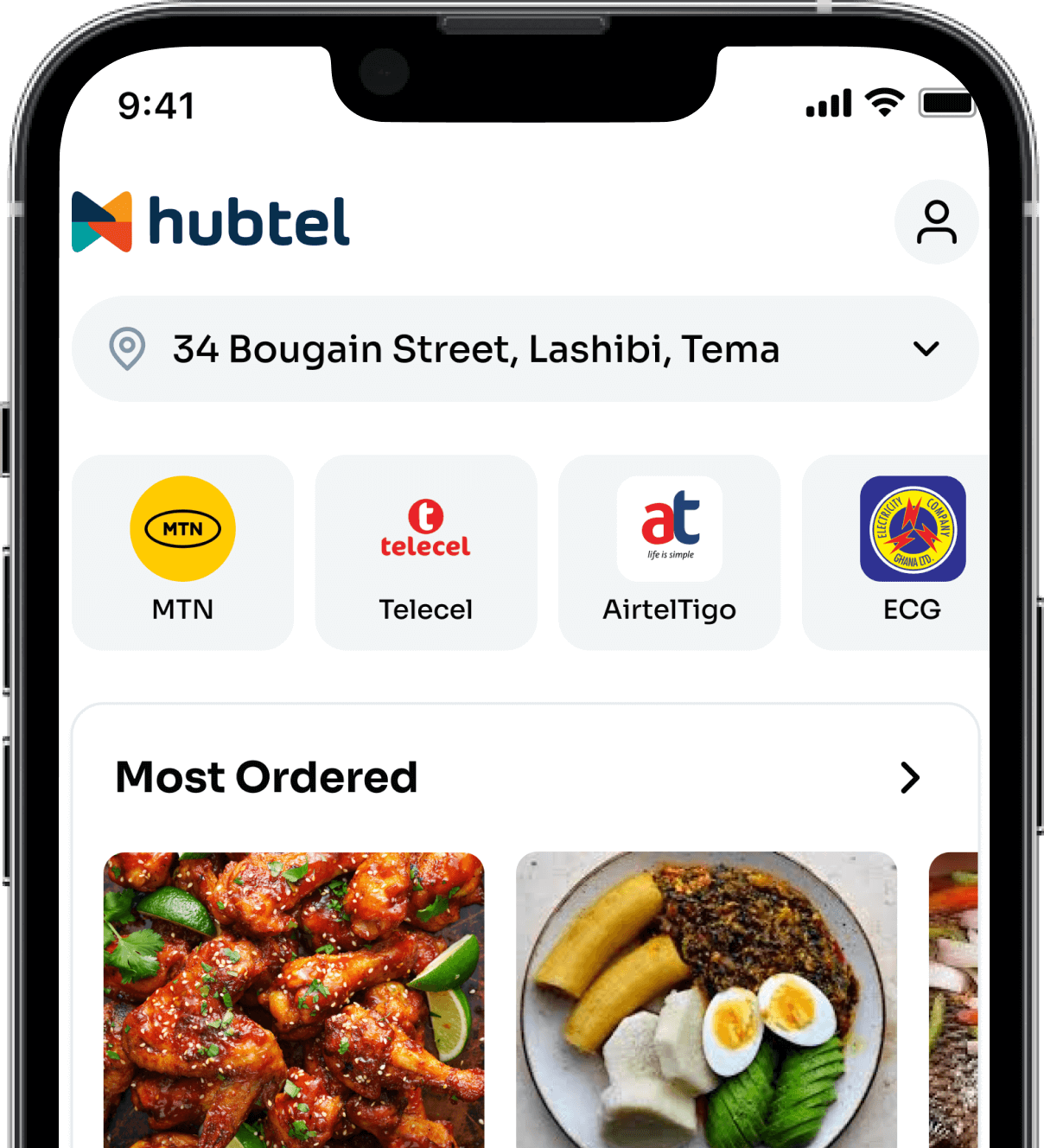

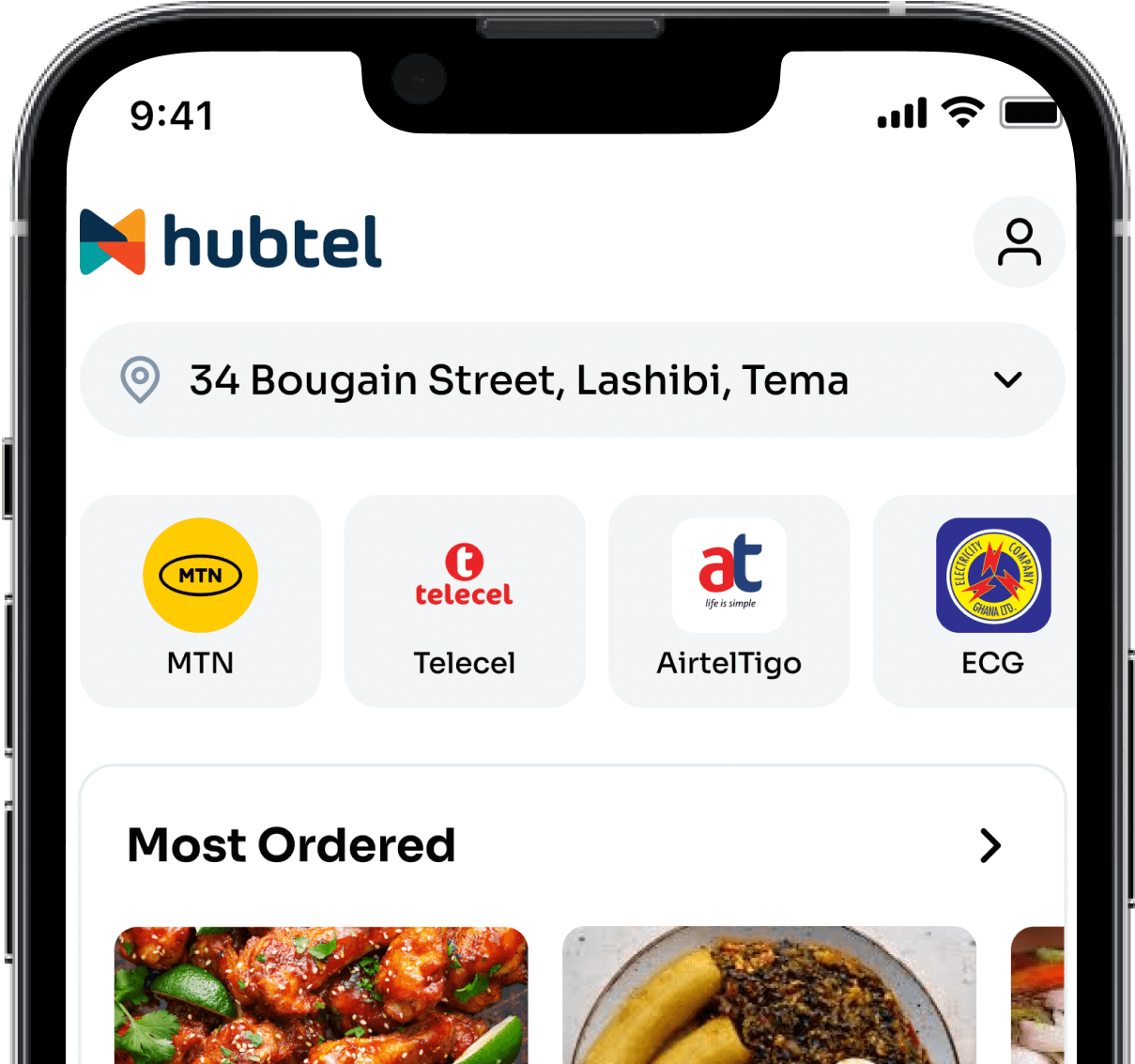

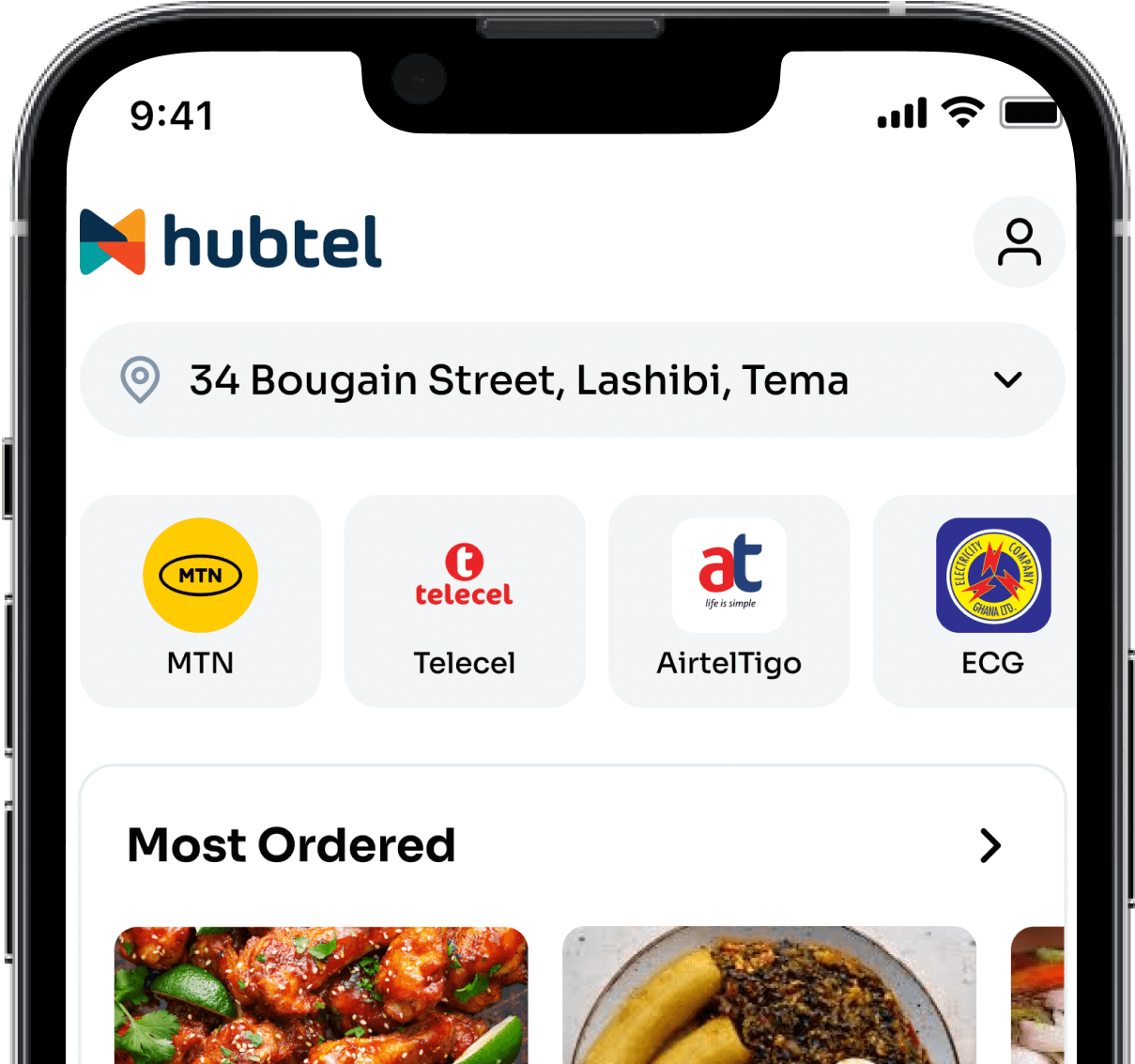

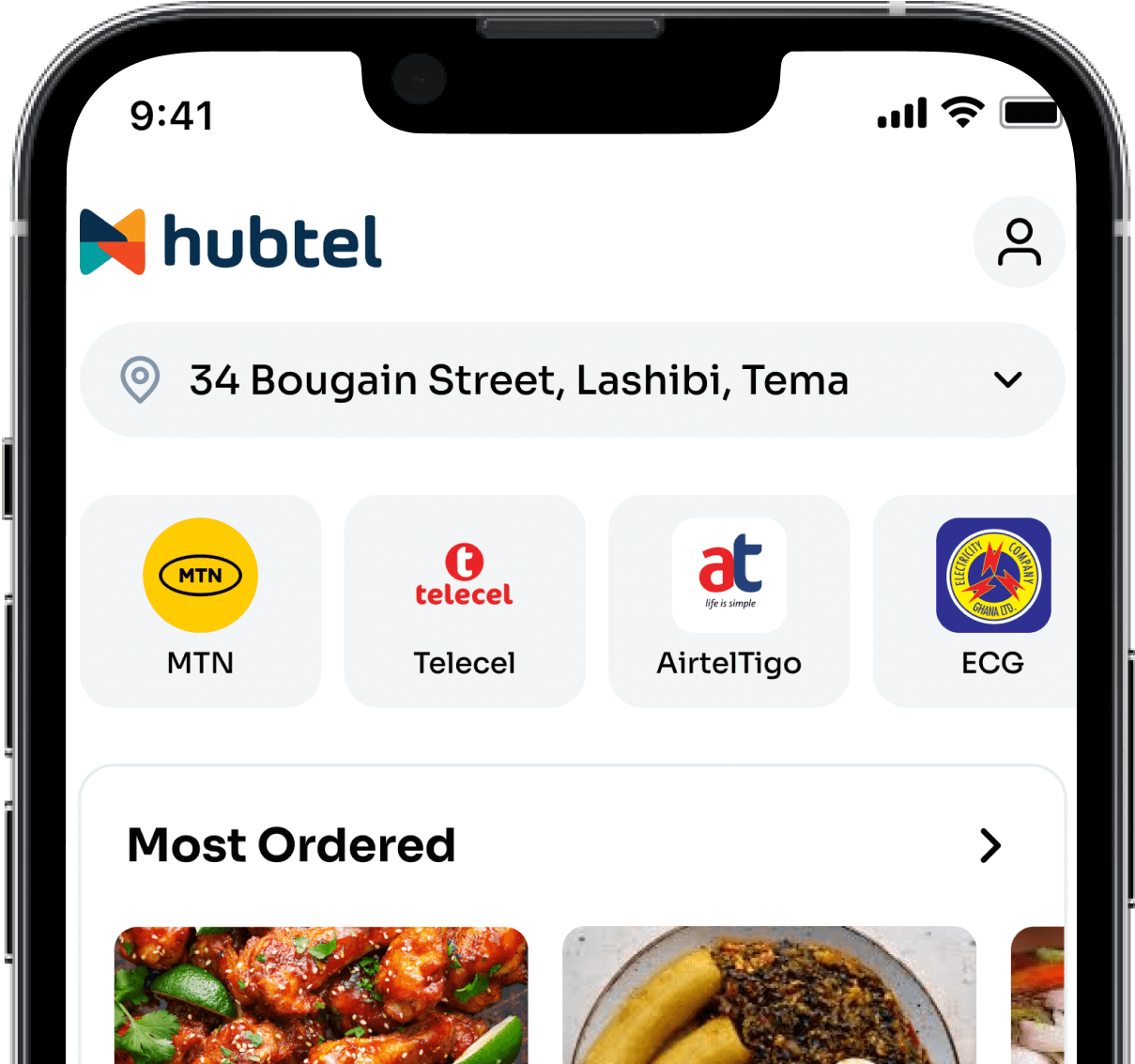

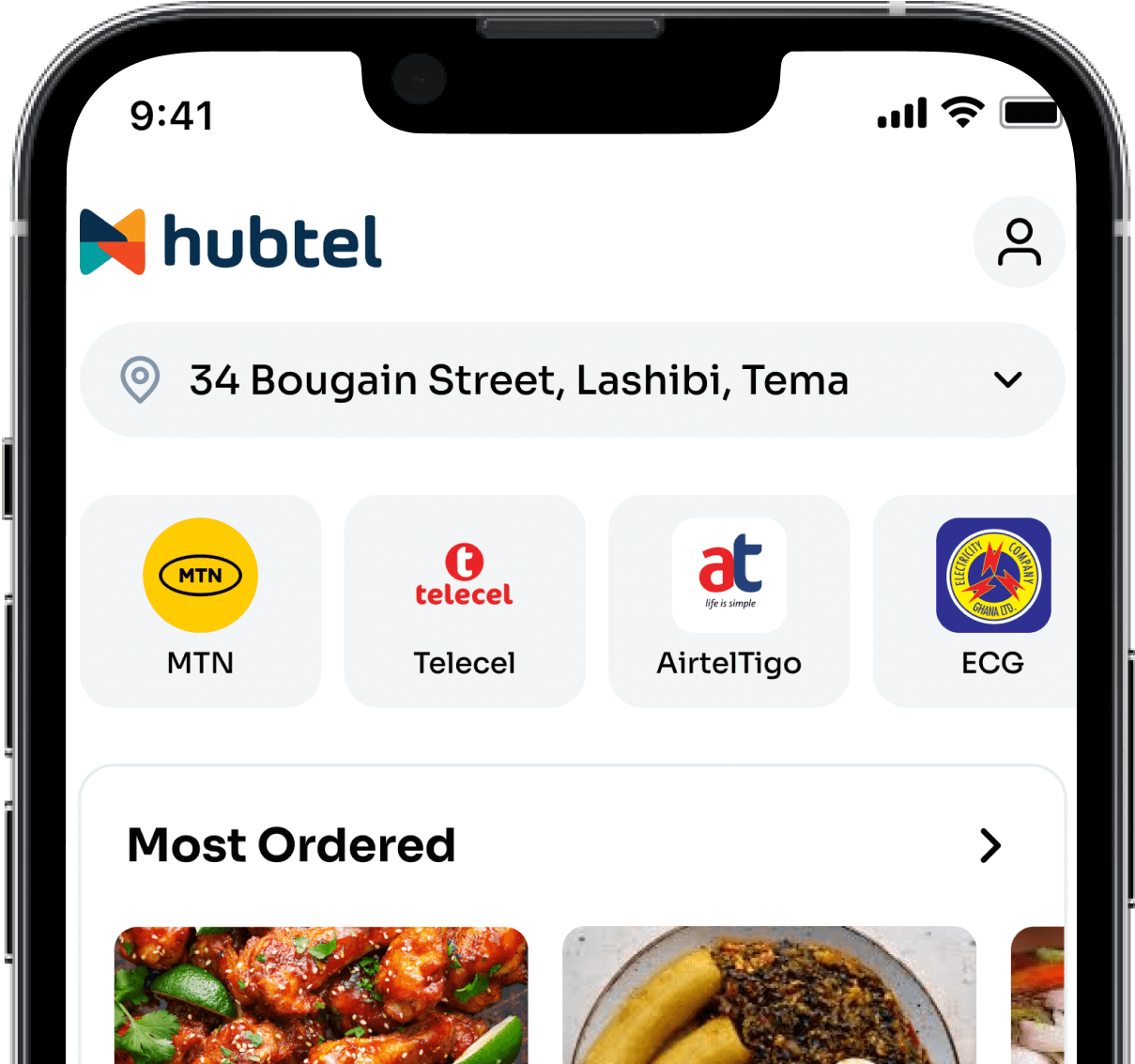

In search of the new direction, the visionary leaders joined The Stanford Seed Business Transformation program in 2016. The program’s goal was to transition the company from a primarily ‘messaging-focused’ business to one that prioritized payment and customer services. The result was the launch of the Hubtel brand and its flagship product, the Hubtel mobile application on May 12, 2017. On the back of the launch of the Hubtel app, what would become Ghana’s first super-app, the company began operations as a Payment Services Provider (Enhanced) following the receipt of approval from the Bank of Ghana in 2019.

The willingness to change and adapt, resulting in the transformation of Hubtel from a messaging-focused business to a digital transformation services provider is a testament to the company’s unwavering commitment to growth, innovation, and excellence.

The Hubtel App

In the fast-paced world of technology, success is often accompanied or preceded by failure. This was certainly the case for Bram, Apenteng and Hubtel. Before the launch of the Hubtel app, in 2012, the company launched MPower Payments, a complete end-to-end online and mobile payment transactions solution that will enable consumers and merchants send, spend, and receive payments. MPower introduced the MPower Mobile Point of Sale application which allowed businesses to accept various forms of cashless payments. However, it did not achieve the desired level of success.

Hubtel faced similar challenges when it first launched the Hubtel app in 2017. The goal was to connect customers and businesses through the app and enhance and make the commercial experience more convenient and simpler. This goal was not achieved during its initial launch. Post launch, the Hubtel app faced numerous hiccups, system failures, and product defects. These issues ultimately led to a less than lukewarm response from the general public. Convinced they were on the cusp of something special, the Hubtel team persevered and launched a new drive to rebuild the Hubtel app and its accompanying platform. Within five months, the company relaunched a fully functional and refreshed product.

Backed by innovatively discerning leaders, a focused management team and a young and tireless workforce, things began, once again, to look up for Hubtel and in 2019, Hubtel received approval from the Bank of Ghana to operate as a Payment Services Provider (Enhanced). By 2021, Hubtel was processing nearly 8.3% of all successful mobile money payments in Ghana, according to data from the Bank of Ghana and the Ghana Interbank Payment & Settlement Systems.

At the beginning of 2023, the company celebrated a significant milestone of over 500,000 app downloads on the Google Playstore alone.

Growth and Achievement

Hubtel has achieved remarkable success since its rebranding in 2017. The company received a full license to operate as an Enhanced Payment Services Provider in 2022, and by the end of that year, it had become Ghana’s largest fintech company in terms of transaction turnover and revenue.

Hubtel has, like its reputation, experienced a significant increase in staff numbers, growing from 60+ employees at the time of the rebrand in 2017 to a robust team of over 270 employees across eight cities in Ghana. Every department has grown by more than 100% in the past six years.

This extraordinary growth is a testament to the dedication and hard work of the team at Hubtel. They have been the backbone of the company, driving its success and ensuring that goals and objectives are met. The company values and recognizes each employee’s unique contributions to its collective effort. As the company continues to blaze new trails in the technology and financial industries, it remains a shining example of what can be achieved through hard work, dedication, and a willingness to pivot in the face of changing market dynamics. The creation, and wide use of the innovative Hubtel ‘super-app’ and platform that connects users to everyday services and local retailers is a manifestation of this.

The Next 18

Hubtel’s 18th anniversary is not just a milestone for the company but also a testament to the power of embracing failure.

“As a company, we have always maintained a startup mentality, constantly learning, trying new things, and embracing failure as a means of driving innovation. We are dedicated to leading the way in Africa’s digital future, with a clear vision to become the most useful company on the continent by providing a platform that enables easy access and participation in the digital economy for everyone”, Alex Bram said.

“Never be afraid to jump at the sun, you will never reach it, but your feet will leave the ground”, this African Proverb was quoted by Alex Bram in his speech during the launch of Hubtel in 2017. Hubtel’s journey, or jump if you will, is a story of passion, resilience, adaptability, and a willingness to learn from setbacks. As Hubtel continues to expand and innovate, it remains committed to its mission of driving Africa forward by enabling everyone to find and pay for everyday essentials and keeping its feet firmly off the ground.

Congratulations to Hubtel, the staff and management and its founders, Alex Bram and Ernest Apenteng, on this remarkable milestone. Here’s to another 18 years of embracing failure and utilizing lessons learnt to spur on innovation and growth.

Related

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Hubtel Pledge Supports St. Augustine’s College with First Coding Lab in Ghana

April 12, 2024| 4 minutes read

Central Bank of Eswatini Visits Hubtel for Peer-to-Peer Learning

April 26, 2023 | 3 minutes read

On Thursday, February 23, 2023, Hubtel had the honor of hosting a delegation from the Central Bank of Eswatini. The visit aimed to explore the fintech ecosystem in Ghana and how Hubtel, has supported financial inclusion in the country.

From February 21 to 23, 2023, the Central Bank of Eswatini (CBE) visited the Bank of Ghana and other key players in the fintech landscape for peer-to-peer learning. Hubtel, one of the key enablers in the fintech space, was handpicked for a visit.

The delegation from the Central Bank of Eswatini and the Bank of Ghana were received by Hubtel’s General Manager, Mr. Ernest Apenteng, and other members of the management team.

The visit began with a brief introduction, followed by a series of presentations on the background and history of Hubtel. The presentation also included an overview of the company’s mission, vision, and values, as well as its growth and achievements.

The main session focused on Hubtel’s operations and products. Presentations covered different aspects of the company’s operations and products, including key products, services, and innovations. The Hubtel team also explained how their products and services are delivered to customers.

The CBE team received presentations on an overview of the regulatory framework for the fintech sector in Ghana and an insight into Hubtel’s relationship with its regulators. In addition to the informative sessions, the CBE team also took a quick tour of Hubtel’s offices, which showcased the company’s work environment, culture, and technology.

In addition to the visit from the Central Bank of Eswatini, Hubtel has also recently hosted a delegation from Regulatory Authority for Electronic Communications and Post Office (ARCEP), Benin led by Lawuratu Musah-Saaka, the Deputy Executive Secretary of the Postal and Courier Services Regulatory Commission, Ghana to engage them on the company’s product and quick commerce operations, specifically courier services. The visit aimed to share knowledge and experiences on how Hubtel has provided innovative and efficient courier services to its customers in Ghana.

The ARCEP delegation was particularly interested in understanding how Hubtel has been able to overcome challenges in the courier industry in Ghana and how the company has been able to deliver efficient and reliable services to its customers. The team from Hubtel provided valuable insights and shared best practices that have helped the company to overcome challenges and improve its services over time.

It is worth noting that Hubtel hosting visits from regulatory officials of the Central Bank of Eswatini and officials from ARCEP, Benin within a month, lends to the testament of the company’s impact in Ghana’s fintech industry. Additionally, this emphasizes the importance of collaboration between fintech companies and regulators in promoting innovation and financial inclusion.

Hubtel remains committed to working with regulators and other stakeholders to create a more inclusive and sustainable digital financial ecosystem in Ghana and beyond. As the fintech industry continues to evolve, it is important for companies and regulators to work together to create an environment that fosters innovation and growth.

Related

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Hubtel Pledge Supports St. Augustine’s College with First Coding Lab in Ghana

April 12, 2024| 4 minutes read

Central Bank of Eswantini Visits Hubtel for Peer-to-Peer Learning

April 26, 2023 | 3 minutes read

On Thursday, February 23, 2023, Hubtel had the honor of hosting a delegation from the Central Bank of Eswatini. The visit aimed to explore the fintech ecosystem in Ghana and how Hubtel, a leading fintech company, has supported financial inclusion in the country.

From February 21 to 23, 2023, the Central Bank of Eswatini (CBE) visited the Bank of Ghana and other key players in the fintech landscape for peer-to-peer learning. Hubtel, one of the key enablers in the fintech space, was handpicked for a visit.

The delegation from the Central Bank of Eswatini and the Bank of Ghana were received by Hubtel’s General Manager, Mr. Ernest Apenteng, and other members of the management team.

The visit began with a brief introduction, followed by a series of presentations on the background and history of Hubtel, including an overview of the company’s mission, vision, and values, as well as its growth and achievements.

The main session focused on Hubtel’s operations and products, with presentations on different aspects of the company’s operations and products, including key products, services, and innovations. The Hubtel team also explained how their products and services are delivered to customers.

The CBE team received presentations on an overview of the regulatory framework for the fintech sector in Ghana and an insight into Hubtel’s relationship with its regulators. In addition to the informative sessions, the CBE team also took a quick tour of Hubtel’s offices, which showcased the company’s work environment, culture, and technology.

In addition to the visit from the Central Bank of Eswatini, Hubtel has also recently hosted a delegation from Regulatory Authority for Electronic Communications and Post Office (ARCEP), Benin led by Lawuratu Musah-Saaka, the Deputy Executive Secretary of the Postal and Courier Services Regulatory Commission, Ghana to engage them on the company’s product and quick commerce operations, specifically courier services. The visit aimed to share knowledge and experiences on how Hubtel has provided innovative and efficient courier services to its customers in Ghana.

The ARCEP delegation was particularly interested in understanding how Hubtel has been able to overcome challenges in the courier industry in Ghana and how the company has been able to deliver efficient and reliable services to its customers. The team from Hubtel provided valuable insights and shared best practices that have helped the company to overcome challenges and improve its services over time.

It is worth noting that Hubtel hosting visits from regulatory officials of the Central Bank of Eswatini and officials from ARCEP, Benin within a month, lends to the testament of the company’s impact in Ghana’s fintech industry. Additionally, this emphasizes the importance of collaboration between fintech companies and regulators in promoting innovation and financial inclusion.

Hubtel remains committed to working with regulators and other stakeholders to create a more inclusive and sustainable digital financial ecosystem in Ghana and beyond. As the fintech industry continues to evolve, it is important for companies and regulators to work together to create an environment that fosters innovation and growth.

Related

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Hubtel Pledge Supports St. Augustine’s College with First Coding Lab in Ghana

April 12, 2024| 4 minutes read

Three years ago, Alex Bram had an idea. The idea was quite simple. He believed there should be an app that connected users to their favorite brands. This connection was quite different and novel, in the sense that users would have the power to purchase digital services from these brands; and review them as well for the kind of service they received. Also, it had a mix of loyalty where users were rewarded every time a digital service was purchased. This was meant to create a positive feedback loop that would keep customers coming back for more. Someway somehow it worked and we all enjoy it to this day.

For this idea to come alive a team of engineers was assembled (sort of like the Avengers. These guys did not have superpowers).

At that point in time, Hubtel’s focus was on businesses and the core of our product was business-facing, so most of the engineering effort and time were put in that direction. This team that was formed was as agile as you can imagine.

These were the members and their roles as of then:

- Alex Bram (Part-time Project Manager)

- Selassie Afenya (Team Lead)

- Liman Labaran (Backend Developer)

- Paul Gamedzi (Front End Developer > Backend Engineer)

- Bill Inkoom (Android Developer)

- Emmanuel Rockson (Visual Designer)

Since we were free to do what we wanted, we chose a different stack as opposed to what Hubtel was using – Microsoft Framework. We went Laravel. On the business platform, Hubtel had users and businesses but because we were building a side app, we created our own users. We also created our own brands and basically created everything that our little platform needed. The app was launched to the public on Hubtel’s birthday, 12th May (2017). We started work on it around July 2016. It was initially named Hubtel Exchange then we did not like that name so we changed it to Hubtel Connect. Then we didn’t like that name either so we changed it to Hubtel Gratis. But Apple said no to that name so we chose Hubtel.me and we got fed up and just removed the .me so now it’s just Hubtel.

The app released to the public was really simple: you could buy airtime and pay some bills and get great rewards for doing that. We started with a few users: less than a hundred. Our daily transaction volumes were in hundreds of cedis a day. We had no ads or no big promotion plans in mind. We wanted the dream of virality, to build a system so good that it would sell itself. As time went on our users increased in number and the volumes came with it. We steadily climbed to GHS 100,000 a month and crossed the 1000-user mark, then we hit a million Ghana cedis in transactions (“a milli, a milli” in Lil Wayne’s voice). That was great.

The fire sort of died down a little bit because we had become another credit-selling and bill-paying app ( a sect of apps that are just waiting to be slaughtered by the Industry Giants (Banks and MTN).

Then Patrick Asare-Frimpong joined Hubtel and for the very first time, we had a full-time Project Manager. He brought fresh energy and new ideas.

The next few months were exciting: we worked on Gift-cards; we worked on fraud prevention and we built our beloved Sophie. She is truly a darling. Sophie is certainly one of a kind, she is a fully automated bot that can process natural language and give level-headed replies. At first, she was just cracking jokes and giving people Hubtel’s phone number. Well, Patrick disagreed and insisted we equip Sophie to become Hubtel’s first Automated Support (RoboSupport). It worked! Sophie can now reverse transactions when issues are reported to her. Her database of possible questions has grown making her a great support personnel to talk to all the time.

Then came a powerful alliance with marketing to create the potential future of Hubtel – the Mobile Mall and Car4ce. Around this time most of the earlier comrades had left and new comrades had entered the scene.

- Max Cofie

- Andy Nickson

- Sam Eshun With a new team and more motivation, work on the mall and CareForce was completed.

A New Dawn

That was the past, and now Hubtel looks to the future. The fragmentation of Hubtel Consumers and Hubtel Businesses will be no more. We all look ahead to forge one story where consumers can go through a Hubtel journey that’s clear as distilled water. A future where the Hubtel app owns no users, owns no streams, owns no transactions and owns no data, and owns no algorithms. A future where everything belongs to the Hubtel platform, allowing us to build many meaningful apps for our lovely customers.

Article by: Bill Nkoom – Software Engineer at Hubtel

Related

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Hubtel Pledge Supports St. Augustine’s College with First Coding Lab in Ghana

April 12, 2024| 4 minutes read