Tag: Payments

In the past few years in Ghana, two popular words have surfaced when it comes to payments and they are “Mobile Money”. In a country where 7 out of 10 people are without bank accounts but yet have more mobile phones than people, (due to multi-sim users), what role can mobile play in impacting our nation’s growth and development?

Financial Inclusion: Between Circle and Adabraka, you are likely to come across 5 different banks yet only 3 out of 10 Ghanaians have bank accounts. The birth of mobile money along with the recent partnerships between banks and telcos in Ghana have made great strides in reaching the unbanked sections of society. Since 1 out of 5, Ghanaians use mobile money banking regularly, free movement of money in the economy that hitherto was hoarded by the unbanked and exchanged just a few hands will be enabled. The movement of money in the economy through mobile money banking will equally affect credit availability because these monies from mobile money transactions end up in the banks and work hand in hand with the telecom companies. The ability to link one’s mobile number to a traditional bank account may further encourage the unbanked to open bank accounts with the confidence that their monies will still be in their “pockets” in the form of a mobile wallet.

Micro Insurance penetration: With Ghana’s insurance penetration to GDP hovering a little below 2%, the use of mobile phones does not only have a place for banks but also a place for the insurance industry as well. In recent times, some telecom companies offer a form of microinsurance via mobile by providing life and health insurance covers to willing phone subscribers. This is made possible through agreed and controlled data sharing between telecom firms and traditional insurance companies who underwrite the policies. One can send a message to a short code and pay a flat rate per month through a direct mobile money monthly debit and enjoy health insurance or life cover. This innovation in insurance in the mobile money sector puts in place a positive outlook for the future of insurance in Ghana. It will also help improve healthcare service delivery in the nation if millions subscribe to this coverage monthly. Imagine 20 million phone users signing on to a minimum GHS5 a month for a GHS1000 hospital bill cover. The income generated by these subscribers will be at least GHS100 million a month and at least GHS1.2 billion a year. If the mathematics of the fund is managed well by actuaries using good data, mobile money could rejuvenate life and health insurance in Ghana. These funds could equally be invested and turned around to earn higher returns in order to positively stabilize the economy.

Employment: The impact of mobile money on employment is a blessing and curse, but more of a blessing. With increased automation of money transactions, certain roles of traditional brick-and-mortar banks will grow dysfunctional, causing a possible retrenchment in areas that have been taken over by mobile and online banking. Imagine, where would the 72,000 mobile money agents littered across the country have been if the innovation of mobile money had never seen the light of day? The private sector through mobile money has hence helped the nation solve the menace of unemployment to a degree.

Tax revenue generation for the State: The government of Ghana relies on funds from various sources in national development and one of these is tax. The generation of transactional taxes from money transfers, corporate taxes from telecom firms, and income tax from commissions of mobile money agents all help drive the developmental agenda of the nation. This is a positive impact indeed for a developing nation like Ghana. One can be assured every successful transaction done via mobile money contributes a quota to national development through tax.

Avenue for financial cybercrime: We cannot speak about the positive impact of mobile money without the threats it also presents. One such key threat is the avenue mobile money creates for financial cyber fraud. Lately, issues of fraudsters hacking or attempting to hack into mobile money subscribers’ accounts are becoming a menace. People of ill motives are devising various means of getting subscribers’ passwords and some successful cases result in huge aggregate sums of money. This issue of mobile money fraud can in the end lead to mistrust of the financial platform and it could result in the possible collapse and lack of interest in the mobile money sector if firm steps are not taken. Because risk presents an opportunity, cyber and financial risk experts can equally take advantage of this to serve as consultants in telecom firms to ensure the financial integrity and safety of the mobile money subscriber are maintained.

In the early 2000’s, researchers found out that some mobile phone users would sell their airtime to friends and family for cash. This clever, but improvised use of airtime as a substitute for money transfer was the precedent on which mobile money was created.

Over the years, mobile money in Ghana has seen significant development because of the many advantages it carries. The service, which was introduced in Ghana in 2009 by Ghana’s leading Telecommunications Company MTN is now offered by tiGO, Airtel and Vodafone. In fact, one out of every five Ghanaians has a mobile money account.

Setting up a mobile money account is fairly easy. Once you have a valid national ID card and a SIM card, you just visit your network provider and an account will be created and linked to your mobile number. The only thing you need to make transactions is your PIN number. Fin. Comparing this with traditional banking, where you would actually have to walk into banking hall, fill out documents, make a minimum deposit and walk out with a cheque book and an ATM, it is easy to understand why many Ghanaians are opting for mobile money instead.

The fact that there are many mobile money agents in Ghana makes it easier and more convenient when you have to withdraw money. Let’s say you live and work in Kumasi and need to transfer some money to your sister in a village. Before the onset of mobile money, you may have had to transfer the money through someone, say a friend or a distant relative. This comes with some delay and risk of your sister receiving less than expected. But with mobile money, no matter which network you use, there is at least one agent who can assist your sister cash out almost immediately you transfer the cash.

Gone are the days when local traders would ply long distances without fear of being robbed of valuables by armed bandits in the middle of their journey. Rather than carrying large amounts of money and hoping for event-free trips, more and more traders now transferring money to their mobile money accounts, travelling light and redeeming their money when they arrive safely at their destination.

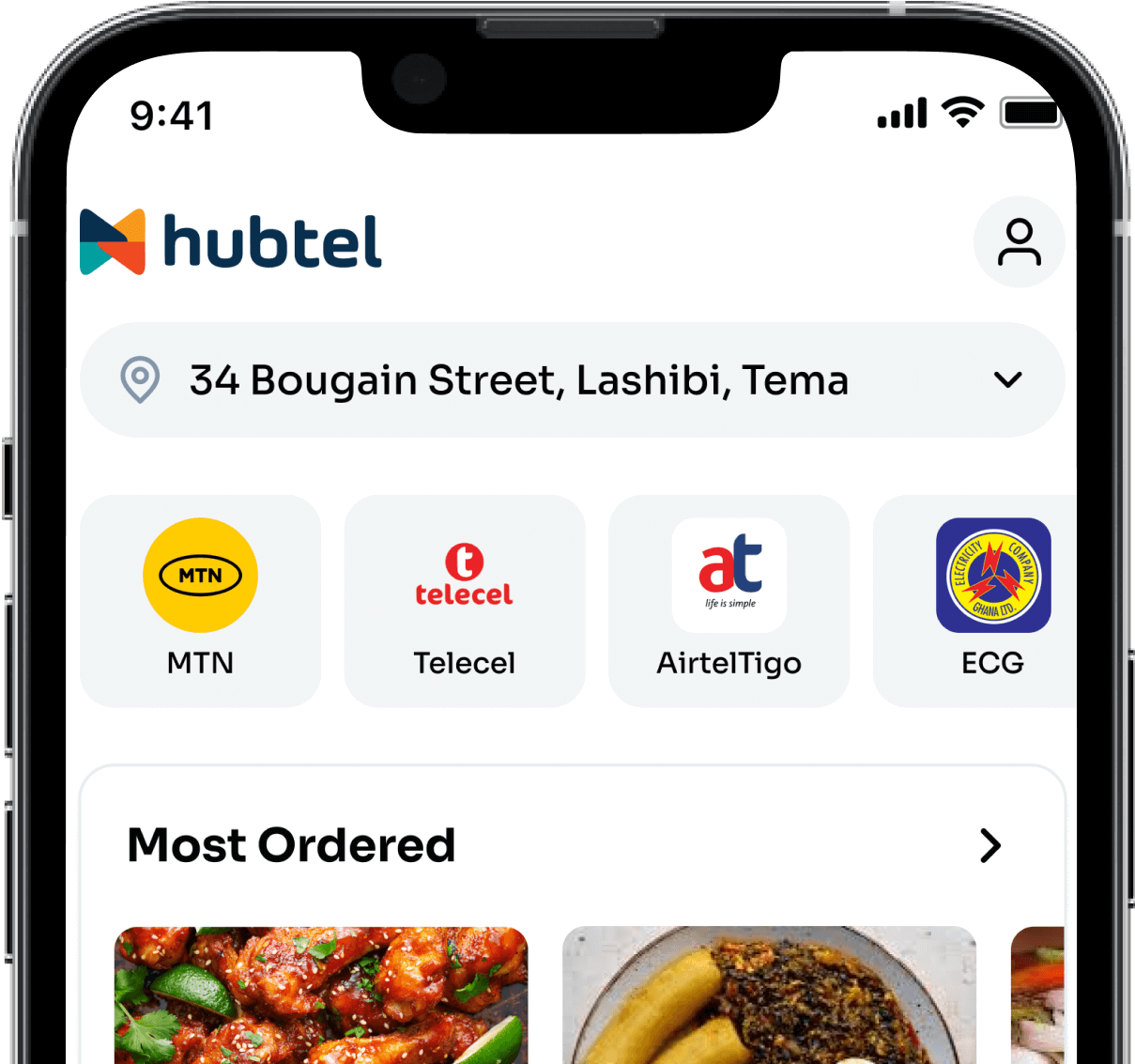

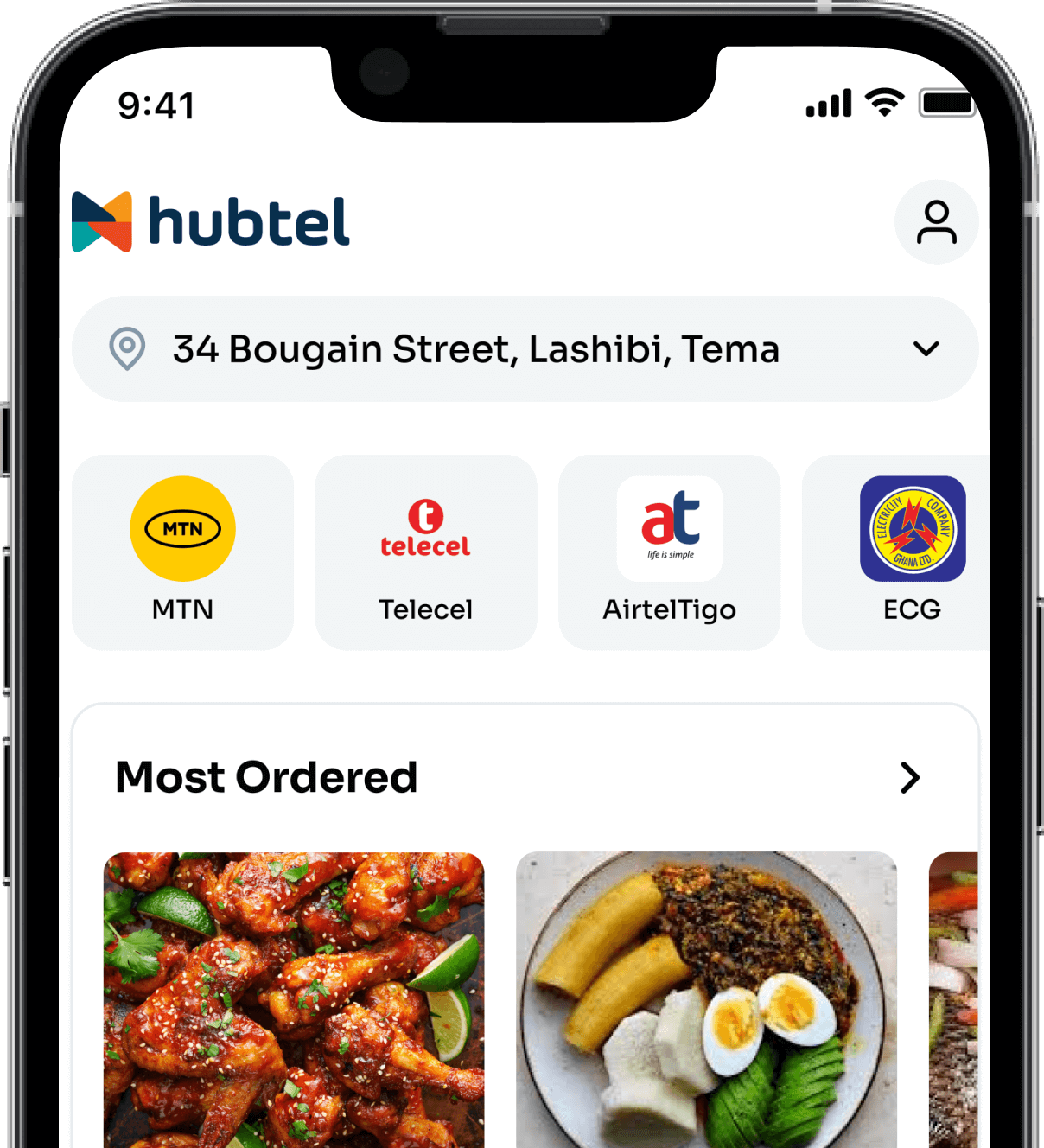

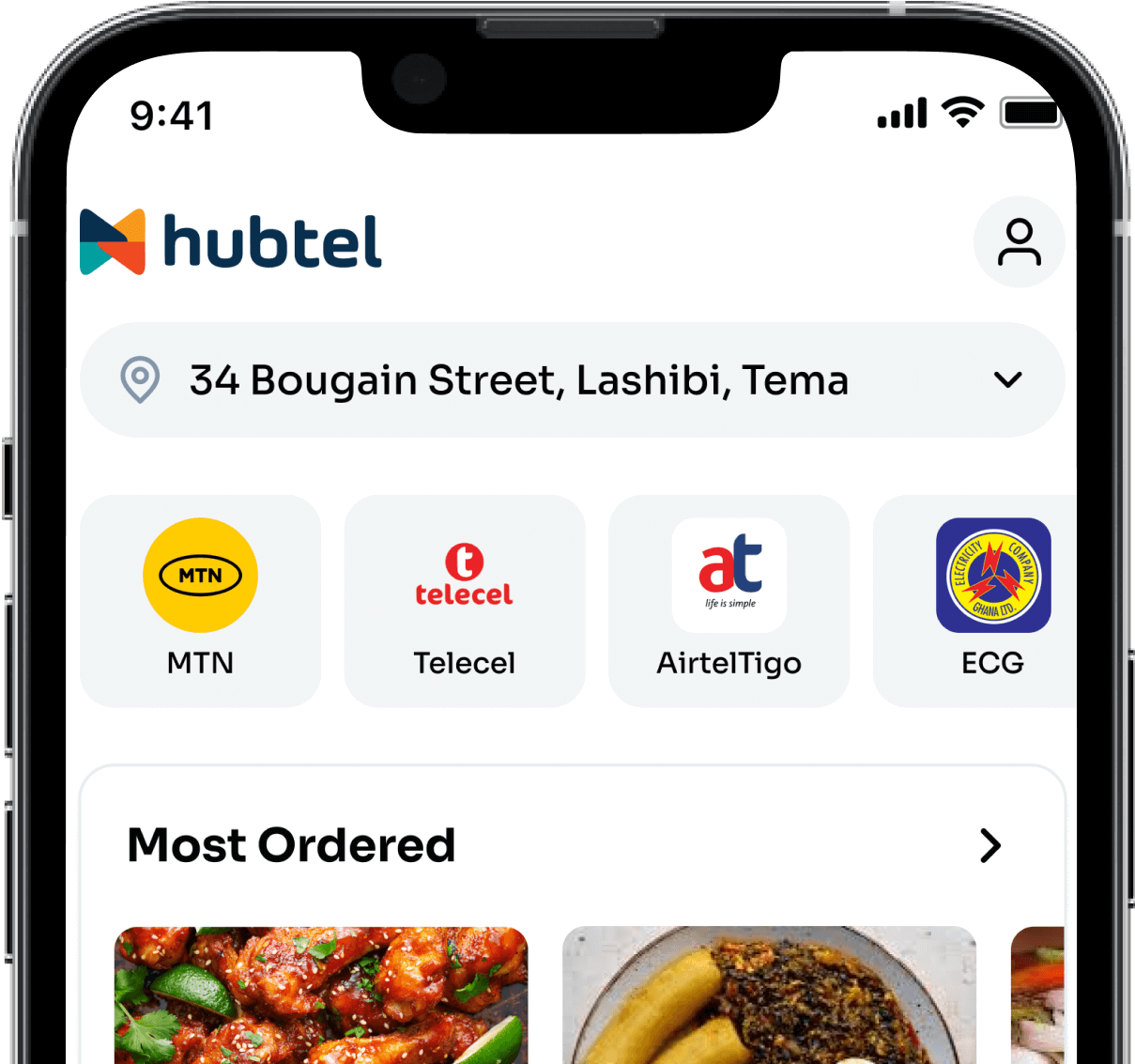

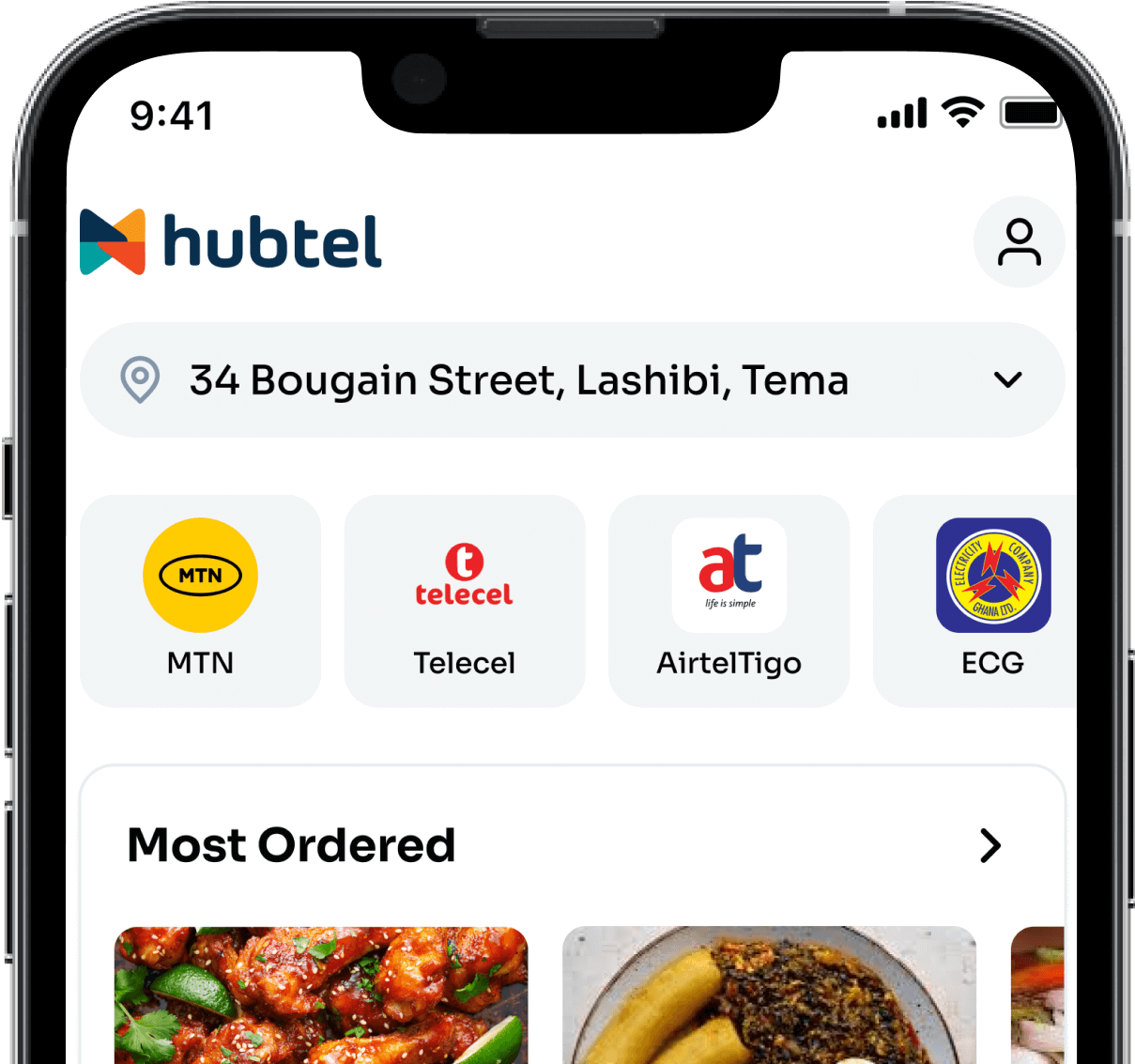

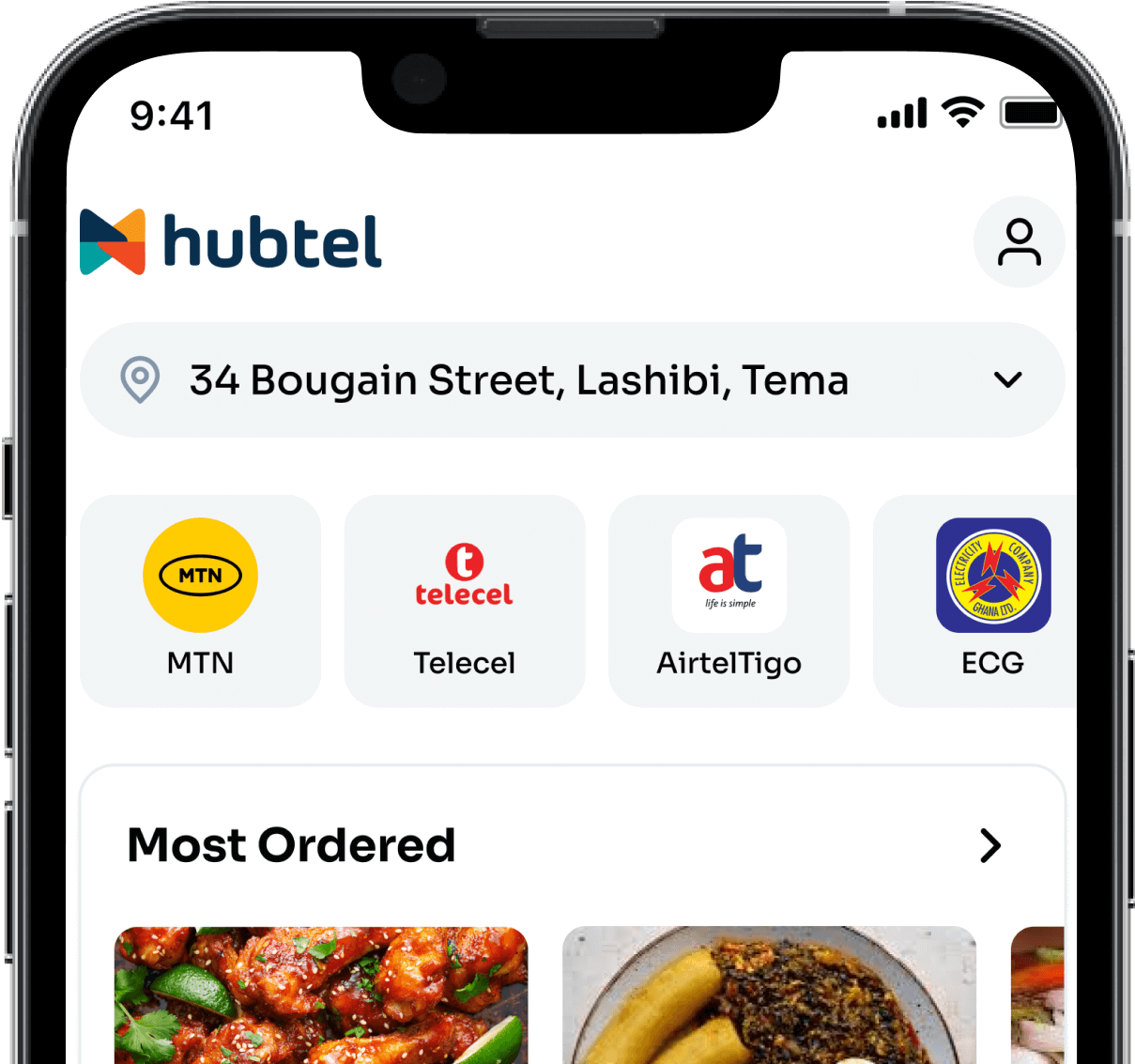

Even though there has been a mass adoption of the service, Ghanaians primarily use the service for cash in/cash out transactions. They do not use mobile money to pay for utilities and make other online purchases as is the norm in Kenya and Tanzania. This indicates that the service is guaranteed to get better as companies begin to take advantage of the unique opportunities opened up by mobile money. Hubtel, for one, offers a Point of Sale (POS) software for businesses who have products or services to sell and want to give their customers the convenience of paying with a variety of payment options including mobile money.

With the burgeoning and innovative use of the service, mobile money in Ghana is guaranteed to continue rising. Who knows, it could even disrupt traditional banking.

MPower Payments is rewarding users for their loyalty in using its payment services. To achieve this, MPower will be giving out rewards in the form of funds to several account owners.

MPower is an online payments service in Ghana offering a complete end-to-end web and mobile payment transactions solution to enable consumers and businesses to send, spend and receive money.

The rewards have been packaged as a standard amount of GHs100 for selected users who keep an active MPower account. The goal here is to reward active users hence the selected user must have completed at least two transactions within the week of selection.

Transactions performed on MPower currently take place in 3 main ways:

- Users transfer/send money or tokens to other accounts including MPower, bank, and the various mobile wallets of local network operators.

- Users also make payments to merchants:

- Purchasing products from online stores that have integrated MPower as a payment option.

- Paying for services from providers who accept remote payments via MPower.

- Purchases on MPower CornerShop:

- Airtime top-ups for all networks

- Internet bundles purchases

- Utility bills payments

- Vouchers vended by services

Users can also initiate another transaction type by making requests to other account owners via PayPal, mobile money wallets, and MPower tokens using the receive money feature on MPower.

Fees and charges that apply per the various transactions performed are listed on the MPower Service Fees page.

The giveaway/offer, which began on October 30, 2015, is set to run weekly till the end of December this year; coinciding with the gifting tradition of Xmas and New Year holidays.

Selections will be made each Friday and payouts will occur instantly to furnish the recipient’s MPower account with the reward. This amount can be spent in the same way as regular funds on MPower.

The MPower service is accessible via web at www.mpower.com.gh and also via mobile on MPower’s android application.

The second Ghana eCommerce Expo was officially opened today, 10th November 2015, by the Deputy Minister of Communications, Hon Felix Kwakye-Fosu. The theme for this year’s conference is: “Unleashing Ghana’s Online Potential” and the event is scheduled to run for two whole days at the Accra International Conference Centre.

Organized by OML Africa, the Ghana eCommerce Expo is a prestigious event for the online business industry.

Over 40 exhibitors made up of eCommerce websites, digital payment providers, software developers, telcos, etc are displaying their cutting-edge solutions to the burgeoning Ghanaian eCommerce market.

The conference running the exhibition is being addressed by 18 experts in the eCommerce industry. Speakers include Haris Broumidis(CEO, Vodafone); Cherian Mathew (V Partner, QNET); Sandra Owusu-Kyerematen (Country Manager, Tonaton); and many other reputable luminaries in the field.